- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

After years of working hard to make monthly mortgage payments, your home is likely to be your biggest asset, particularly, if you’ve benefited from an increase in house prices over the last few decades.

The value of your home (minus any existing mortgage and other loans secured against it) is referred to as equity. This equity is often passed on as an inheritance. However, an increasing number of people are tapping into some of this value to help boost their retirement finances or help their children get onto the property ladder.

If you’re wondering if equity release is right for you, you’re in the right place. This article will take you through some of the basics of equity release before speaking to an expert equity release adviser.

Equity release is a way for homeowners aged 55 or over to release tax-free funds from their homes without having to move. With a Lifetime Mortgage (the most popular type of equity release), there are typically no monthly repayments to make as the loan, plus roll up interest, is repaid when the plan comes to an end. Usually, that’s when you, or the last remaining applicant, either passes away or moves into long-term care. With a lifetime mortgage, you’ll still retain full ownership of your home.

The money can be released to you as either a single lump sum or as an initial release amount, then further releases can be taken as and when needed, known as a drawdown lifetime mortgage.

With a lifetime mortgage, you have the right to remain in your home for as long as you choose to, or until you move into full time residential care or pass away. You also have the freedom to move to another property and transfer your loan without an early repayment charge (subject to the new property being acceptable to your lender at the time).

You will never owe more than the value of your home with the no negative equity guarantee.

The money can be used for a variety of purposes and is often used for:

Hundreds of thousands of people are already enjoying the benefits of cash they’ve unlocked from their homes. However, equity release may not be suitable for everyone, which is why it’s important to get expert advice before you make a decision.

You may be eligible for an equity release if:

You can borrow a percentage of the value of your property, but this depends on various factors such as your age and the value of your property.

With home reversion, you’ll usually get between 20% and 60% of the market value of your home (or of the part you sell). You should check whether you can release equity in several payments or in one lump sum, the percentage of the market value you will receive and the minimum age at which you can take out a home reversion plan.

Mortgage Advice Bureau Later Life offer lifetime mortgages only. A lifetime mortgage is a loan secured against your home. Equity release will reduce the value of your estate and may affect your entitlement to means-tested benefits. Mortgage Advice Bureau Later Life offer lifetime mortgage products from a carefully selected panel of providers.

To make sure you receive the best possible advice, we have specialist equity release advisers that can advise you on lifetime mortgages. Mortgage Advice Bureau Later Life work with Key Retirement Solutions who provide our Later life lending proposition.

We can help you to arrange a free consultation with an expert equity release adviser. To book a free consultation for you or a family member, please call us on 03454 500200 alternatively click here and complete this short form about yourself. We’ll be in touch very shortly. With business partners nationwide, you are never too far from financial advice.

Mortgage Advice Bureau Later Life offer lifetime mortgages only. A lifetime mortgage is a loan secured against your home. Equity release will reduce the value of your estate and may affect your entitlement to means-tested benefits. Mortgage Advice Bureau Later Life offer lifetime mortgage products from a carefully selected panel of providers.

Unless you decide to go ahead, our service is completely free of charge, as our fixed advice fee of £1,295 is only be payable on completion of a plan.

You should always think carefully before securing a loan against your property.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

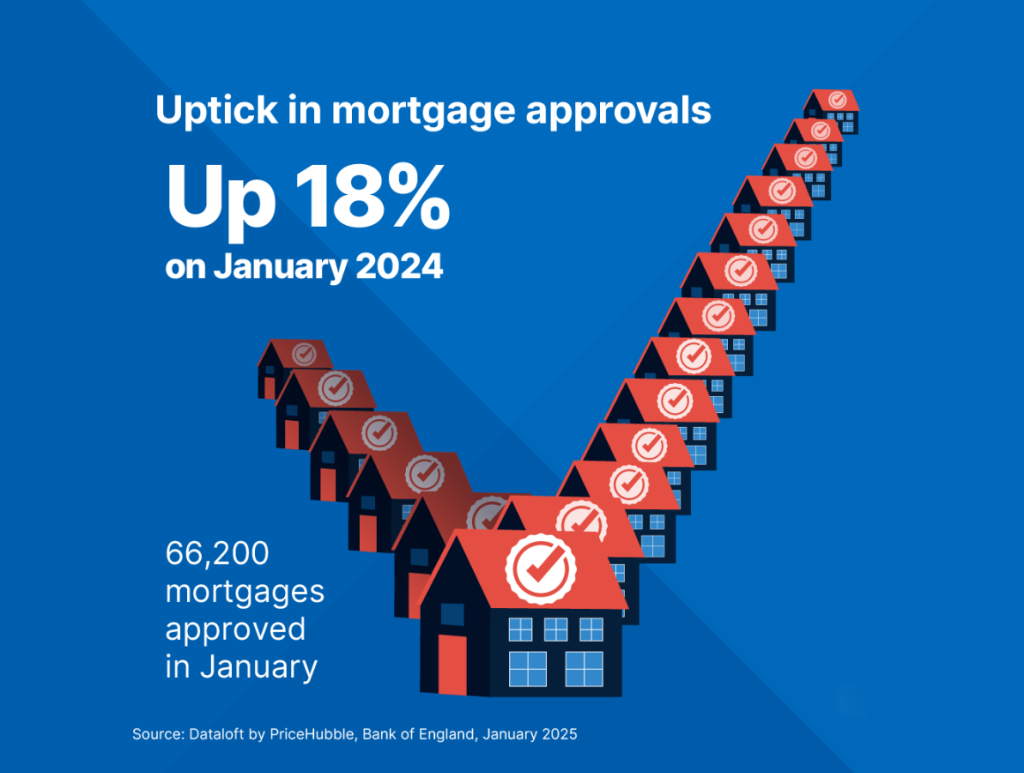

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

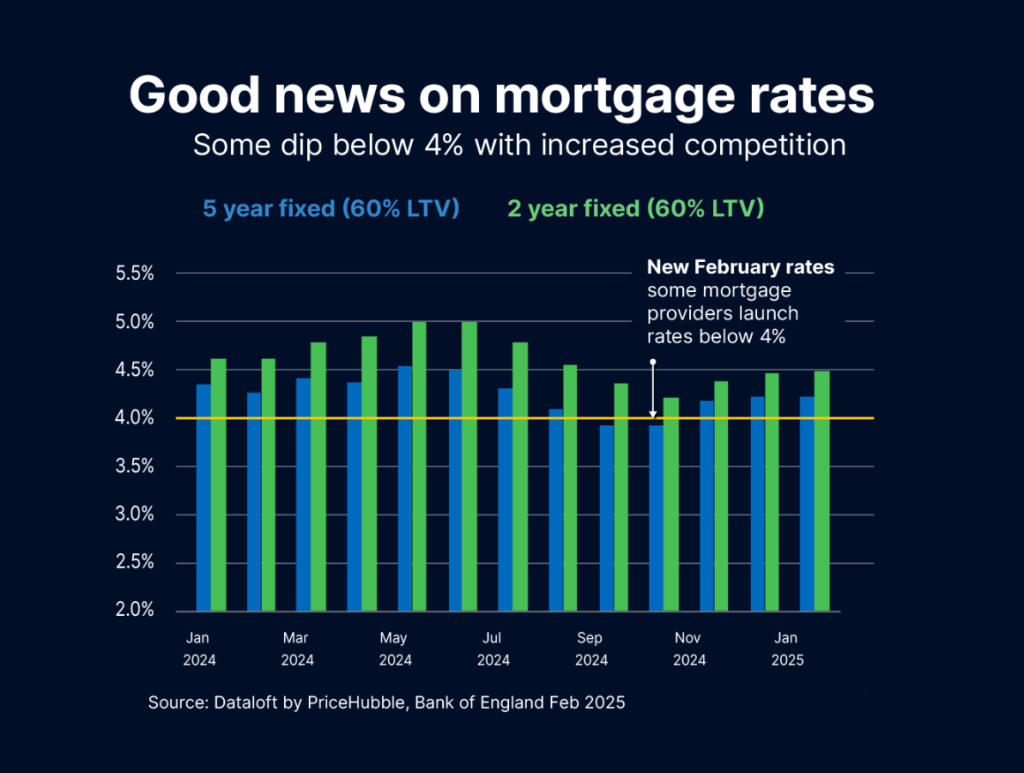

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…