- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

If you are planning on building your own property, a standard residential mortgage won’t be right for you. You need a specialist self-built mortgage.

Speak to one of our self-build experts who can guide you through the process and help you to find the right lender for your build. Our Mortgage & Protection Advisers have years of expertise in this field so call 03454 500200 to book your appointment.

A self-build mortgage is a loan you take out to fund a property you are building yourself.

With a self-build mortgage, the funds will be released to you as the stages of the development progress, as opposed to receiving a ‘one-off’ lump sum that you would receive if you were buying a traditional pre-built residential home.

When funds are released depends on the lender. You’ll typically receive the first payment when you buy the land, more when the foundations are laid and a further payment when the property is built up to eaves level.

From your lender’s perspective, this will reduce their risk and give them the confidence that the money is being used at the scheduled times within the construction plan. From the homeowner or builder’s perspective, this means the project will continue to be funded until the property is completed.

There are two types of self-build mortgages.

The arrears mortgage is the most popular type of self-build mortgages. Funds are released after each build stage is completed. This type is best for people with accessible cash as you will be required to cover the cost of the build and then apply to the lender for reimbursement once the work is finished.

This type of mortgage is offered by a limited number of lenders.

Advance mortgage funds are released at the beginning of each stage giving you money to pay for labour and material costs. This type of mortgage is best for people with limited cash to fund the self-build, making it a more streamlined experience. It also diminishes the need for bridging loans and other short-term borrowings.

You will need to provide the bank or building society with planning permissions, construction drawings, Building Regulations approval, proof of site insurance, structural warranty, and a breakdown of your build costs, including your plot cost. We can help you calculate these costs.

This type of mortgage is different to your standard, residential mortgage. With standard mortgage the funds are released on completion of the building process.

With self-build mortgages, you will receive stage payments as you build your house.

If you are building your own property from scratch, funds will typically be released at the following points in the build:

When you receive the funds depends on the type of self-build mortgage you have.

If you have an arrears self-build mortgage you will receive mortgage payments when the work is complete at each construction stage. With an advance self-build mortgage, funds will be received ahead of each stage, meaning you can pay contractors and suppliers quickly and efficiently.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

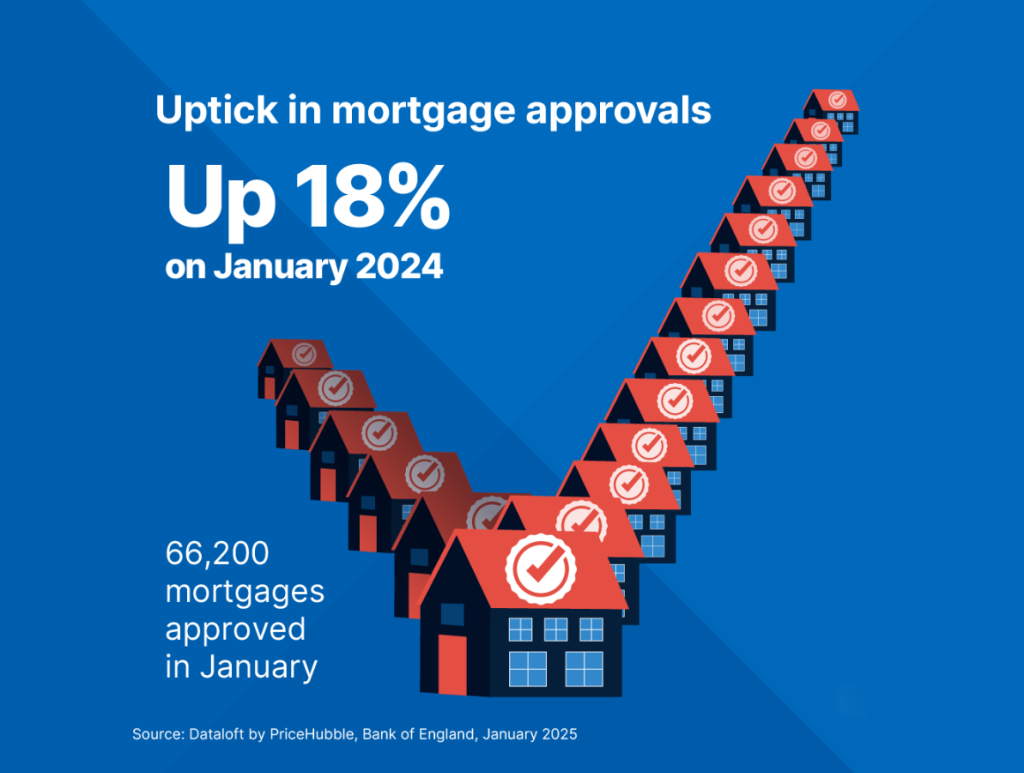

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

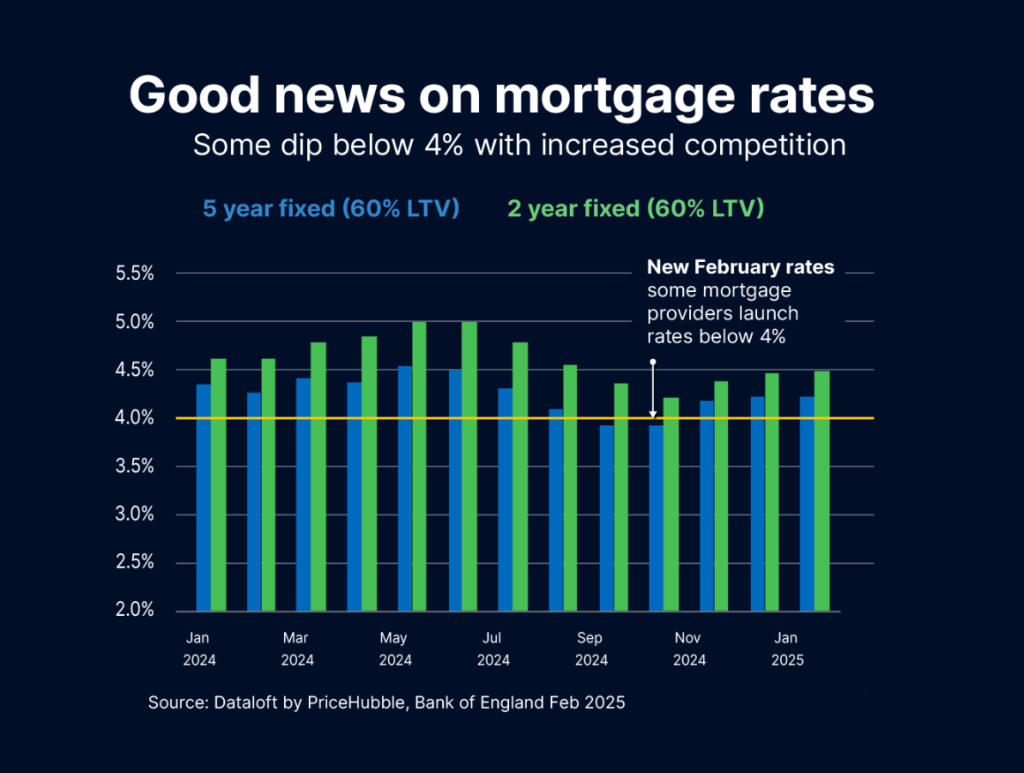

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…