- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

A police mortgage is no different from a standard mortgage, but being a police officer can work in your favour as lenders see it as a low-risk profession. While there is no specific mortgage product for police officers, there are options available that cater to the unique needs of emergency service personnel.

Most mortgage lenders have a guideline that sets the maximum mortgage amount at four times the borrower’s salary. However, being a police officer with a stable career and future growth potential can increase your borrowing power. Many lenders are willing to offer mortgages of up to 4.5x, 5x, or even 6x your salary.

Lenders also consider other sources of regular income, such as overtime, second jobs, maintenance payments, benefits, and self-employment income. However, these sources need to be consistent and prove their value through bank statements or tax returns.

While a longer time in your career can increase your chances of a successful mortgage application, some specialist lenders are willing to consider applications from new police officers, even during their probationary period.

If you are married or in a civil partnership, your partner’s income can be added to yours when calculating your mortgage affordability. However, if your partner has any specialised issues such as bad credit or being self-employed, it may affect your application.

The minimum deposit you need for a mortgage depends on the type of mortgage you apply for

Higher Loan-to-Value (LTV) mortgages require a smaller deposit, typically around 5% or 10% of the property value. However, they often come with higher interest rates as they are considered riskier for the lender. An example is a 95% LTV mortgage, where you borrow 95% of the property value and put down a 5% deposit.

Lower LTV Mortgages require a larger deposit, typically 15% or more of the property value. They come with lower interest rates as they are less risky for the lender. An example is an 85% LTV mortgage, where you borrow 85% of the property value and put down a 15% deposit.

Your creditworthiness plays an important role. Borrowers with a strong credit history and good financial record may be eligible for lower deposit mortgages even with higher LTV ratios.

Additionally, different lenders have their own criteria and may offer mortgages with varying minimum deposit requirements.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

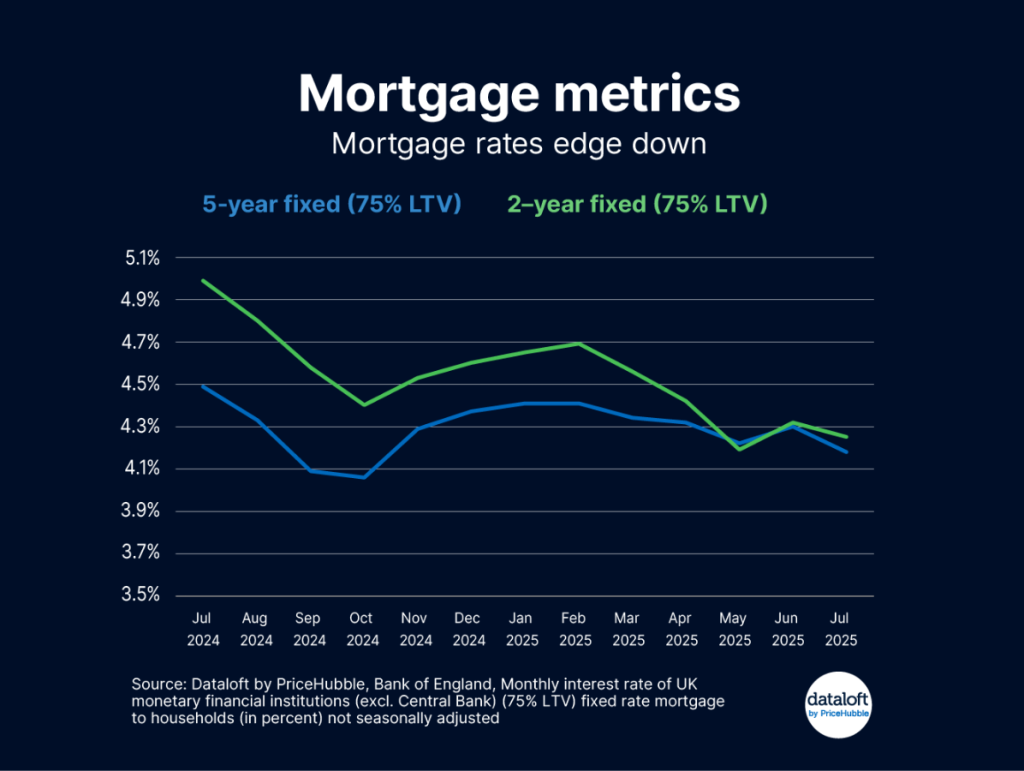

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…