- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

Moving home is one of the most exciting times of our lives. Whether it’s for a growing family, a new school catchment area or just a great fresh start, we can help you make the right move. If you need help with a new mortgage or want to find out if you can transfer your existing mortgage, we’ll guide you through the whole process to make your move as seamless and stress-free as possible.

We prioritise getting the right mortgage for you. We start by getting to know you, making sure we get all the information we need to source and secure the mortgage that’s the right fit for you and your move. Once we have everything we need, we’ll deal with all the paperwork and manage the entire process from application to offer to completion day, when all the fun begins in your new home.

All the time our friendly team of local mortgage advisers will keep you up to date with everything you need to know, offering advice and support at every step.

We don’t just do mortgages – your protection is important too. If you’d like to know more about looking after the important things in life, we can help with those too. Ask us about:

If you would like to know more about the mortgage process or the different types of mortgages available, read our FAQs or give us a call on 03454 500200, alternatively click here and complete this short form about yourself.

We’ll be in touch very shortly. With mortgage brokers nationwide, you are never too far from mortgage advice.

Moving home can be a daunting process. Aside from the cost of the property, there are other costs you will need to factor in when you are budgeting to move home, from mortgage costs and legal fees through to stamp duty and more.

Whether you are searching for a new property or preparing to move into a new home for the first time, we will be able to assist you, and we have created a helpful guide outlining everything that you need to know about the cost of purchasing your new home.

You can find the latest information about Stamp Duty Land Tax by visiting: https://www.gov.uk/stamp-duty-land-tax/residential-property-rates.

All mortgage lenders will assess the value of the property you are looking to purchasing in order to establish how much they are prepared to lend you. As a general rule of thumb, you should expect to pay anything from £150-£1,500, depending on the value of your property and the type of valuation that you choose to have conducted on the property.

If a structural survey is required then you will need to pay separately to have this done alongside the lender’s valuation, the lender will always need to do their own valuation even if you have your own carried out.

Some lenders will offer a free standard valuation on selected mortgage products but this is something you would have to discuss when sourcing the lender and products available.

When purchasing any property, you must also take into account any legal fees such as your solicitor costs or licensed conveyor who will be responsible for completing all legal work involved in buying and selling your home. Prices range from £850-£1,500 and it is always worthwhile comparing solicitor quotes before committing to a vendor. You will also have to factor in costs for local searches which are between £250-£300 but most solicitors will include this within their total costs, so always check the quotes when you receive them.

Your estate agent will also expect to be paid a fee for the services they provide. This is usually 1% to 3% of the sale price plus 20% VAT.

This is important, as it is vital that you do not commit to a property that you cannot afford. With this in mind, you should use a Mortgage Affordability calculator to see how much you can afford to borrow and if it is sustainable. We can also provide you with an Agreement in Principle with a lender that will suit your needs and circumstances to ensure that you know what you are able to borrow.

Finally, you should always factor in costs to repair your property if there are any problems. It is wise to have a contingency budget which will allow you to cover the cost of any repairs. There are lots of other moving home tips that can be really helpful with the entire process, so make sure that you do plenty of reading around before jumping in headfirst. You can find more information on our specialist moving home pages; alternatively, contact us today by ringing 03454 500200 to find out more or email hello@mortgagedecisions.com.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

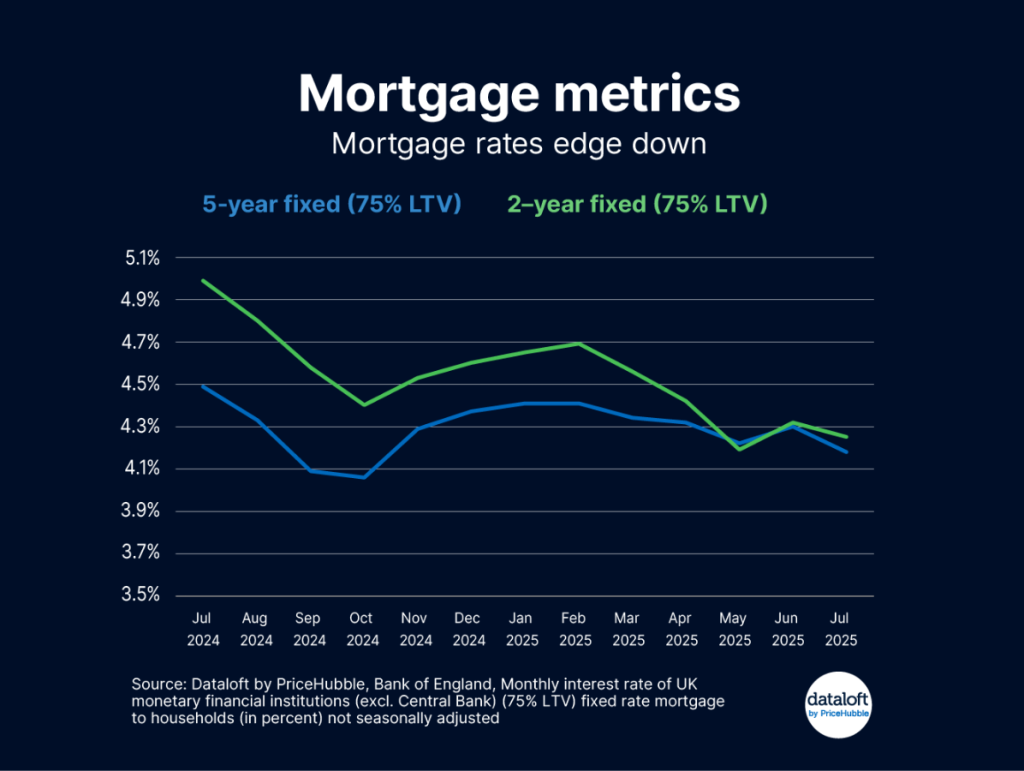

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…