- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Fortunately, there are multiple mortgage lenders who specialise in approving applicants with defaulted credit accounts on their record. This means that if you have missed a payment on a loan or have ignored a debt, you still have options for obtaining a mortgage.

However, it is important to note that defaults on a credit file are a common reason for mortgage rejections, especially with traditional lenders. These lenders typically only approve applicants with a flawless credit history.

Thankfully, the Advisers we work with are experts in securing mortgages for individuals with defaults. Even if you have been declined for a mortgage in the past due to a default, there are still other lenders who may be willing to work with you.

It is important to understand that each lender has their own criteria and specialties. Some may offer low rates and work with individuals with a clean credit history, while others specialise in self-employment or adverse credit.

Working with a mortgage broker can be beneficial in quickly locating lenders who are more likely to approve your application, without the hassle of comparing numerous rates on your own.

Our Mortgage & Protection Advisers are knowledgeable about which lenders offer favourable rates and terms for individuals in your circumstances, and can guide you towards saving money throughout the mortgage process.

In order for your Mortgage & Protection Adviser to effectively assist you, it is crucial to be open and honest about your finances and circumstances from the start. All conversations are confidential, and providing accurate information will ensure a smooth and timely application process. Any delays could result in missing out on a better rate or losing your desired property.

It is important to note that not all defaults hold the same weight in a lender’s decision. While all lenders consider secured loan or mortgage payment defaults to be serious, some may be more lenient towards missed payments on smaller accounts such as mail order or mobile phone contracts. Defaults on credit cards and loan repayments fall in the middle ground.

Defaults remain on your credit file for six years, which can impact your ability to access credit in the future. However, contrary to popular belief, it is still possible to find competitive adverse credit mortgages even with a default (or multiple defaults) on your record.

The longer a default has been on your record, the less impact it is likely to have on your mortgage approval. It is important to continue to work on improving your credit rating after the six-year mark.

The waiting period after a default before you can get a mortgage depends on the severity of the default, your credit score recovery, and the lender’s criteria. Defaults stay on your credit report for six years in the UK. However, this doesn’t necessarily mean you have to wait that long to apply for a mortgage.

Many assume that repaying bad debts before applying for a mortgage is crucial, but this is not always the case. While it may improve your credit score, it is not essential for all lenders. Some more flexible lenders do not even use a credit scoring system. Mortgages with settled defaults are typically easier to obtain, and some lenders may grade your application into a certain risk tier, which will determine your interest rate.

Generally, lenders who accept defaults are more concerned with when the default was registered, rather than when it was settled. This means that mortgages with unsatisfied defaults are just as likely to be approved, as long as the dates of registration fall within the lender’s criteria.

The amount you can borrow with a default may be limited, as adverse credit mortgage lenders tend to have stricter affordability calculations than traditional lenders. While those with a clean credit history can borrow up to 5 times their income, those with defaults may be limited to 4-4.5 times their income, depending on the severity of the default. Lenders may also require a higher deposit in these cases.

Your income plays a significant role in obtaining a mortgage with a default. Different lenders have different criteria, with some only accepting 100% of basic salary and others considering overtime and bonuses.

Self-employed individuals may be required to have a longer track record, while employees may need to have been in the same role or with the same employer for a certain period of time. Other financial commitments, such as personal loan repayments, can also impact the maximum loan amount.

It is crucial to check your credit history before applying for a mortgage, even if you are aware of any defaults. Different lenders use different credit rating agencies, so it is recommended to check with multiple agencies. This will also help you identify any other issues that may negatively affect your credit score.

You can obtain your credit reports once a year from each agency for free. It is worth checking for any other issues, such as late payments, CCJs, IVAs, or bankruptcy declarations, as these can also impact your credit score.

If you are considering a commercial mortgage and have a default on your record, it is important to note that many commercial lenders will not consider an application if a default has occurred within the past two years. It is best to consult with a broker before applying, as they can assess your credit report and provide guidance on how to improve your chances of approval.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

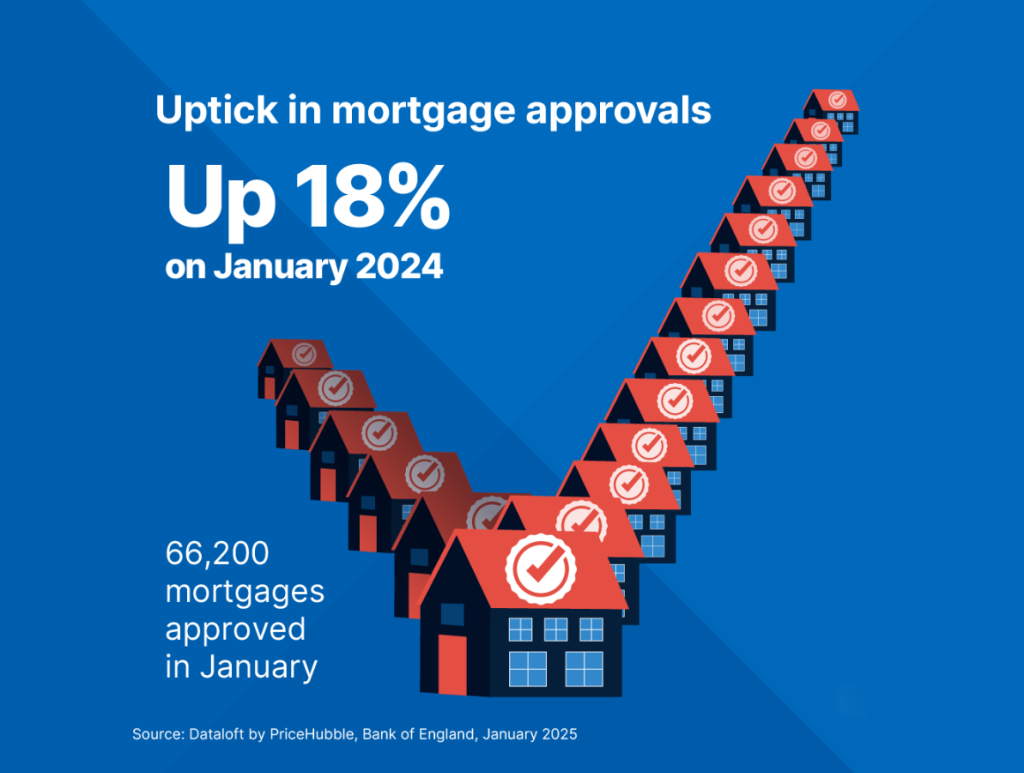

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

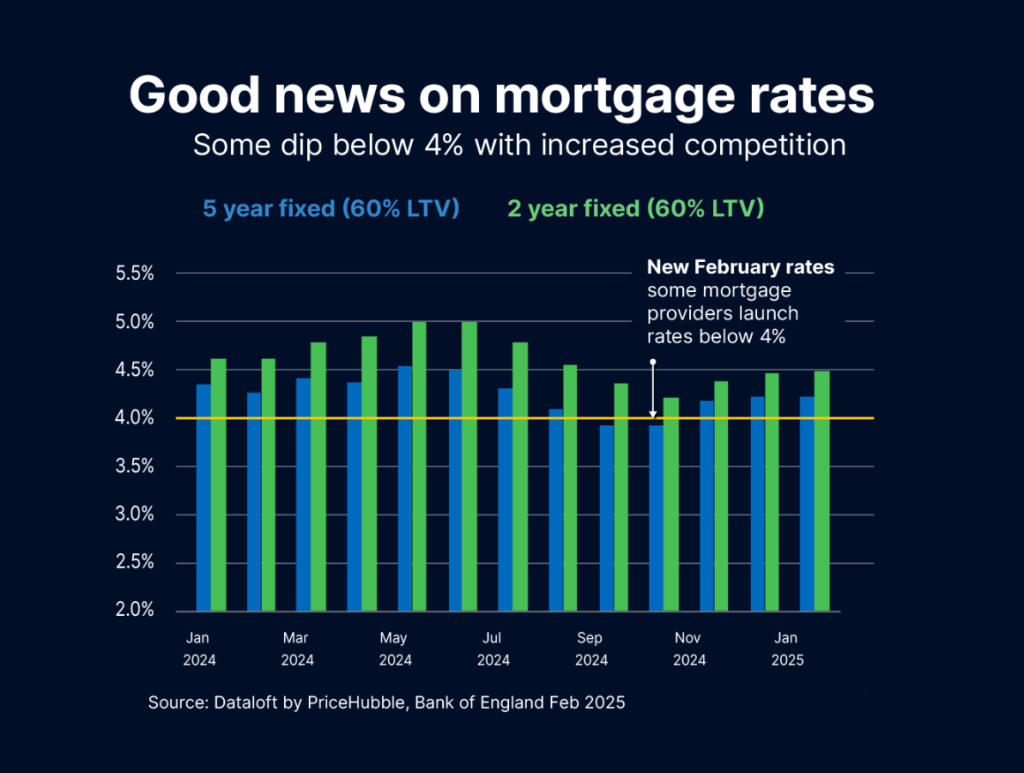

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…