- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

Buying your dream home is an exciting and rewarding step, but as a first-time home buyer, you may be feeling nervous, and maybe even a little overwhelmed by the process. That’s why we’re here to help. We’re here with all the advice and support every first-time buyer needs to secure their first home.

Our team of mortgage experts understands the unique challenges and opportunities that come with buying your first home. We’re here to answer your questions and help you find the right mortgage for your first home purchase. We’ll talk you through all your options, including the latest deals and mortgage products that will be the right fit for you and your home. We understand that in those first important years of home ownership, you’ll want to keep your costs down.

The world of mortgages can seem daunting for first-time buyers, but we are here to make it as easy as possible. So, when you’re ready to make your first step towards home ownership, we’re here.

If you’d like to know more about the mortgage process or the different types of mortgages available, read our FAQs below.

Or feel free to get in touch! Call us now on 03454 500200, alternatively click here and complete this short form about yourself. We’ll be in touch very shortly. With mortgage brokers nationwide, you are never too far from mortgage advice.

A first-time buyer is someone who is looking to purchase their first home. This typically means that you haven’t owned a property before, either in the UK or abroad. As a first-time buyer, you may be eligible for certain incentives and schemes that can help you get on the property ladder.

The first step is to do your research and compare different lenders and mortgage deals to find the one that’s right for you. You’ll also need to make sure that you have a good credit score and enough income to meet the lender’s requirements. A mortgage broker can help you navigate the process and find the best tips for your situation.

When you’re buying your first home, you’ll need to put down a deposit. This is the amount of money you pay upfront, and it shows the lender that you’re committed to the purchase.

Generally, most lenders require a minimum deposit of 5% of the property’s value, but some may require more.

To help first-time buyers, the government offers different schemes:

How much you can borrow as a first-time buyer depends on various factors, such as your income, credit score, employment status, and the size of your deposit. Lenders will typically use a formula to calculate how much they’re willing to lend you, taking into account your income and expenses.

To give yourself an idea of how much you may be able to borrow, you can use a mortgage calculator. However, it’s always best to speak to a mortgage broker who can provide you with personalized advice based on your individual circumstances.

Well, they take into account your salary, monthly outgoings, and deposit size. Lenders will want to be sure that you can still afford your monthly mortgage repayments even if interest rates rise significantly.

So, they’ll assess your income and expenditure, including big monthly bills such as rent or utilities, finance, credit card and debt repayments, childcare, entertainment, car and travel costs, and more.

To prepare for your mortgage application, you can estimate the size of the mortgage you may need and use a handy mortgage repayment calculator to work out what your monthly repayments will be based on the value of your new home, your income, and expenditure.

An agreement in principle, or AIP, is like a preliminary mortgage offer from a lender.

An AIP can give you an idea of how much you might be able to borrow, which can help you narrow down your property search. It can also show sellers that you’re serious about buying and may give you an edge in a competitive housing market.

As a first-time buyer, there are several types of mortgages available to you, each with their own advantages and disadvantages.

Here are the most common types of first-time buyer mortgages in the UK:

With a fixed-rate mortgage, the interest rate you pay stays the same for a set period of time, usually between two and five years. This makes it easier to budget, as your monthly payments will remain the same. However, if interest rates fall, you won’t benefit from lower payments.

An SVR is the default rate that a mortgage lender will put you on when your fixed or introductory rate period comes to an end. The rate can go up or down at any time, and you’ll need to keep a close eye on it to ensure you’re not paying more than you need to.

Tracker mortgages follow the Bank of England base rate, which means your payments will go up or down in line with any changes to the base rate. This can be a good option if you think interest rates will stay low or fall, but you’ll need to be prepared for your payments to increase if interest rates rise.

Discount rate mortgages offer a discount on the lender’s SVR for a set period of time. For example, if the lender’s SVR is 4%, a discount rate mortgage might offer a 1% discount for two years. This can be a good option if you’re looking for lower initial payments, but you’ll need to be prepared for your payments to increase when the discount period ends.

A capped mortgage is similar to a fixed-rate mortgage, but the interest rate can go down if interest rates fall. However, there is a cap on how high the interest rate can go, so you’re protected if interest rates rise.

With an offset mortgage, your savings are linked to your mortgage, which can help reduce the amount of interest you pay. For example, if you have a mortgage of £200,000 and savings of £20,000, you’ll only pay interest on £180,000. This can be a good option if you have significant savings, but you’ll need to be prepared for potentially higher initial payments.

When deciding which type of first-time buyer mortgage is best for you, consider factors such as how long you plan to stay in the property, your income and outgoings, and your attitude to risk. It’s also a good idea to seek advice from a mortgage broker, who can help you understand your options and find the best deal for you.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

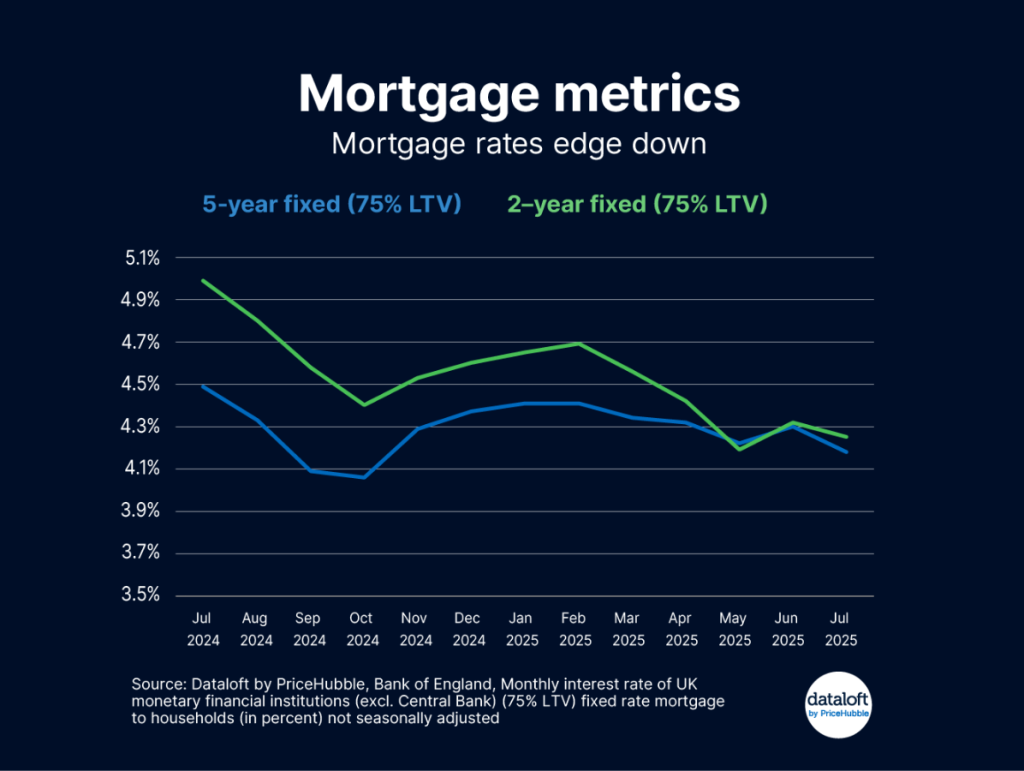

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…