- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Buy-to-let mortgages are specifically designed for individuals who want to purchase properties for investment purposes, aiming to generate rental income and potential capital growth. Unlike residential mortgages, buy-to-let mortgages consider the rental income potential of the property as a key factor in assessing affordability.

Whether you’re a first-time investor or you’re an experienced landlord considering adding to your property portfolio; if you’re thinking of investing in a property to rent out, a buy-to-let mortgage is a safe and affordable way to fund it.

The amount you can borrow will depend on your deposit, your personal financial circumstances and the rental income you’re expecting to achieve on your new property. Most buy-to-let mortgages are available on an interest-only basis, which will keep your monthly outgoings low. Typically, the minimum deposit you will require will be 25% of your purchase property’s value.

At Mortgage Decisions, we understand the unique requirements of investors in the buy-to-let market. Our team of experts will guide you through the process, helping you compare different buy-to-let mortgage options to find the best fit for your investment strategy.

If you’d like to know more about buy-to-let mortgages and how they can help you take your first steps onto the investment property ladder, read our FAQs below or read out guide here.

Or feel free to get in touch! Call us now on 03454 500200, alternatively click here and complete this short form about yourself. We’ll be in touch very shortly. With mortgage brokers nationwide, you are never too far from mortgage advice.

A buy-to-let mortgage is specifically designed for individuals who want to purchase a property for investment purposes, with the intention of renting it out to tenants. Unlike a regular residential mortgage, where the borrower intends to live in the property, a buy-to-let mortgage takes into consideration the rental income potential of the property.

The key differences between a buy-to-let mortgage and a regular residential mortgage include:

With a buy-to-let mortgage, lenders typically assess the borrower’s ability to repay the loan based on the potential rental income generated by the property. In contrast, a residential mortgage considers the borrower’s personal income and financial circumstances.

Buy-to-let mortgages often have slightly higher interest rates compared to residential mortgages. This is due to the increased risk associated with investment properties and the potential fluctuations in rental income.

Buy-to-let mortgages usually require a higher deposit compared to residential mortgages. Typically, a deposit of 25% or more of the property’s value is required, although this can vary depending on the lender and the borrower’s individual circumstances.

Buy-to-let properties are subject to different tax rules and regulations compared to owner-occupied properties. Rental income is subject to income tax, and landlords may also have to pay additional taxes such as Stamp Duty Land Tax (SDLT) and Capital Gains Tax (CGT) when selling the property.

The eligibility criteria for obtaining a buy-to-let mortgage in the UK can vary among lenders. However, here are some common factors that lenders consider:

The deposit required for a buy-to-let mortgage is generally higher than that for a residential mortgage. While the exact deposit amount can vary depending on the lender and the borrower’s circumstances, a typical deposit for a buy-to-let mortgage is around 25% of the property’s value.

However, it’s important to note that higher deposit amounts may be required, particularly for more niche or specialized properties. Lenders often consider the loan-to-value (LTV) ratio, which is the percentage of the property’s value that the mortgage represents. A lower LTV ratio may result in more favorable mortgage rates and terms.

It’s worth noting that the affordability assessment for a buy-to-let mortgage primarily focuses on the potential rental income generated by the property rather than the borrower’s personal income. It’s essential to conduct thorough research and consult with a mortgage advisor to determine the deposit requirements specific to your investment plans and financial situation.

When assessing affordability for a buy-to-let mortgage, lenders consider several factors:

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

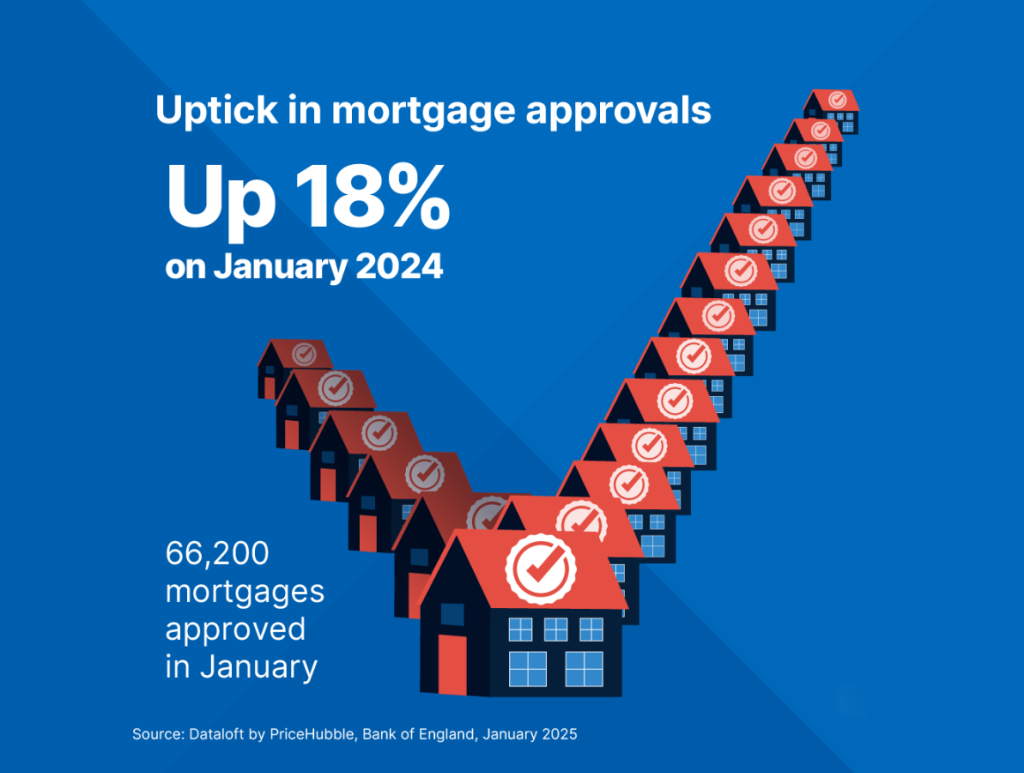

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

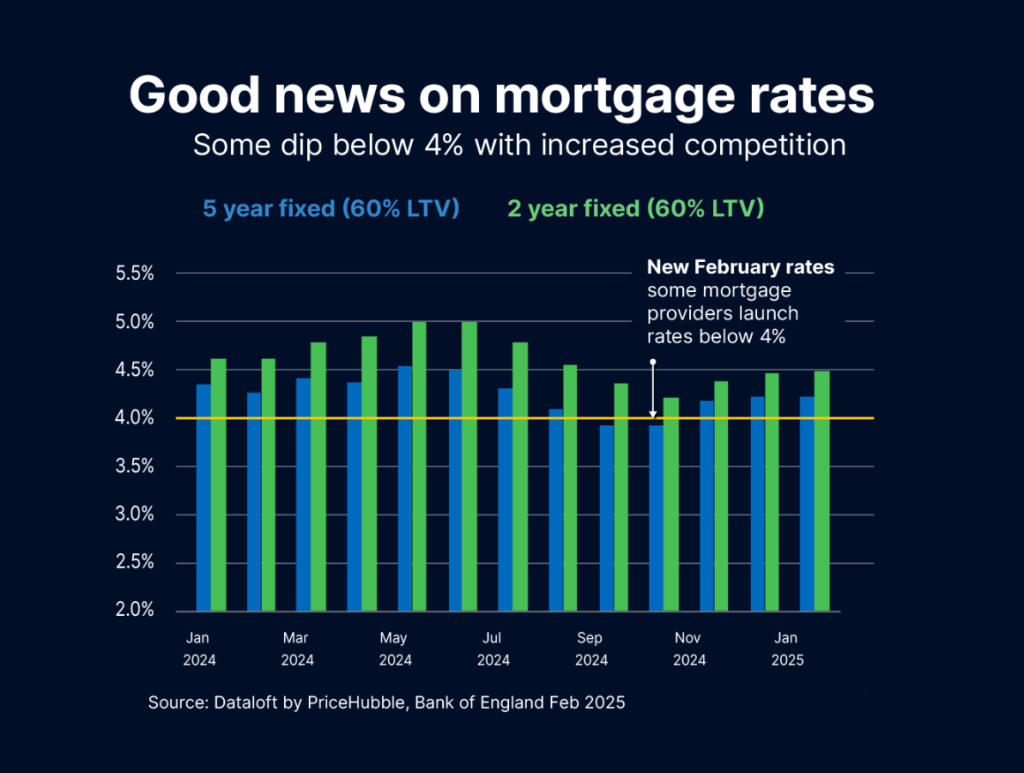

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…