- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

Many lenders are willing to approve applicants with a bad credit history, including those who have experienced bankruptcy. However, obtaining a mortgage in this situation can be a complicated process. It is important to understand the requirements and expectations of lenders before submitting new mortgage applications.

The length of time since your bankruptcy was discharged will impact your eligibility for a mortgage. While some lenders may consider applicants immediately after discharge, it is more common for them to require a few years to pass and for the applicant to have a good credit history during that time.

To improve your chances of obtaining a mortgage after bankruptcy, it is important to regularly check and correct any errors on your credit reports. Working with an experienced professional can also help you determine your eligibility and develop a plan to improve your credit score.

Having a larger deposit and being prepared for higher interest rates can also increase your chances of being approved for a mortgage after bankruptcy. It is also recommended to close any dormant credit accounts and be cautious when making new credit applications.

While some lenders may still consider your application with new credit issues post-bankruptcy, it is best to seek advice from a specialised broker who can help you find the best deal for your specific situation.

There are approximately 20 lenders who will consider mortgage applications from discharged bankrupts, but eligibility requirements will vary. It is also possible to use equity in your home to repay bankruptcy debt, but it is important to seek professional advice in this situation.

Finally, it is important to be careful with credit applications after bankruptcy, as too many can negatively impact your credit score. Utilising the expertise of a mortgage broker can help you find the best deal without hurting your credit score. Take the necessary steps to improve your eligibility for a mortgage in the future.

Bankruptcy is one way for individuals deal with debts they cannot pay. It doesn’t apply to companies or partnerships, ultimately the bankruptcy process is making sure what assets and anything you do have left is shared among those creditors that you have. It then lets you make a fresh start, debt-free, but there are some restrictions as to what you can do to apply for new credit.

You may be eligible to apply for a mortgage after bankruptcy, but only once you have been discharged from your bankruptcy order. The specific timeframe for this discharge may vary among lenders.

You need to be discharged from your bankruptcy first, typically this is a period of six years, but this can be as little as one year. An experienced Mortgage & Protection Adviser will be able to guide you accordingly at this point.

You would need an increased deposit following bankruptcy, dependent on the amount of time that has passed since being discharged bankrupt. Generally, at least a 25% deposit will be necessary. However, as time progresses and you move further away from your bankruptcy discharge, this deposit requirement will decrease.

You will have to be prepared to pay a higher rate of interest in the early stages after bankruptcy, but this will not be the case for the full term of the mortgage.

Post-bankruptcy credit issues can significantly hinder your ability to obtain credit, as lenders may view your discharge as a fresh start. However, any subsequent credit problems can further impede your ability to secure credit in the future.

You may be eligible for a Buy To Let mortgage following bankruptcy, however, the timeframe for approval is typically longer than that for a residential mortgage. In most cases, applicants can expect a waiting period of up to six years.

Utilising the equity in your home is a viable option for repaying bankruptcy debt. This can be facilitated by a reputable lending provider, providing you with the means to do so. We recommend consulting with a knowledgeable Mortgage & Protection Adviser to receive expert guidance in this matter.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

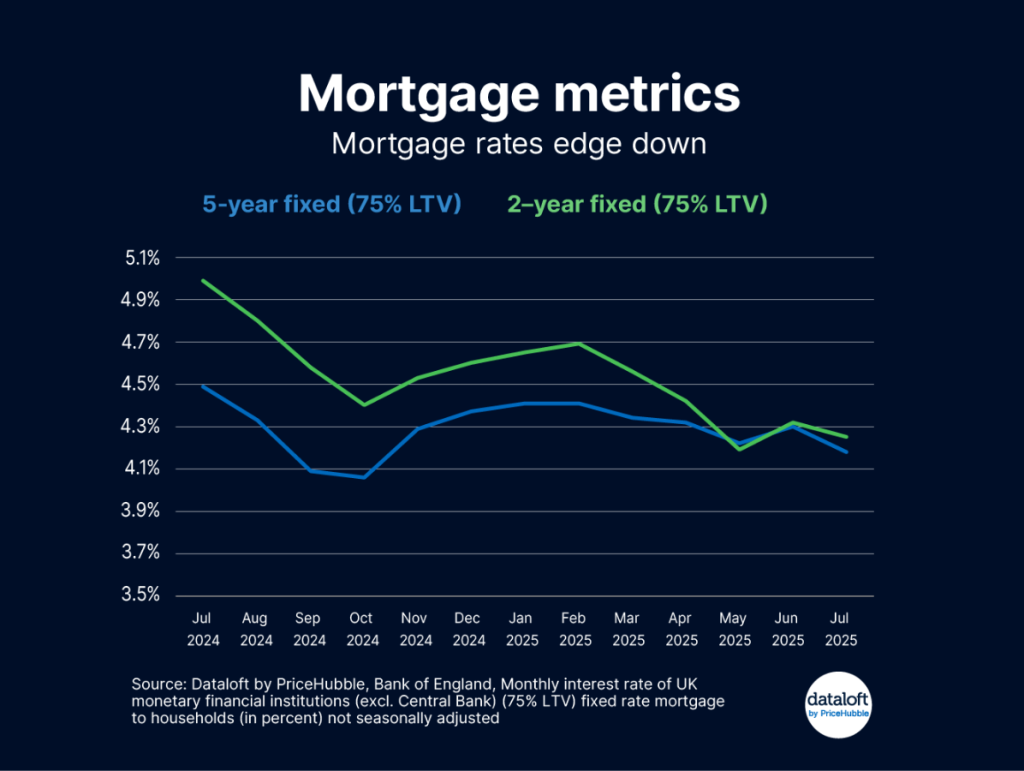

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…