- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Are you a recent self-employed individual with only one year’s worth of accounts? You may find it challenging to obtain a mortgage compared to someone who is employed or has more than three years’ worth of accounts. Lenders may require additional evidence to evaluate your affordability and eligibility.

While it may be more difficult to get a mortgage with only one year of accounts, it is not impossible. There are many lenders that specialise in self-employed mortgages for individuals with limited accounting history or income evidence.

Whether you are a company, sole trader, contractor, or self-employed individual, you should be able to apply for a self-employed mortgage. The qualification used to determine if someone is self-employed is usually if they own 20% or more of the business or company.

Self-employed mortgages are also available for individuals who want to purchase a buy-to-let property, have a business that has undergone recent structural changes, or have been self-employed for only one year and have bad credit.

You can also obtain a self-employed remortgage for personal or business investment. This can be particularly helpful if you have been able to improve your credit rating or have additional accounts to demonstrate your affordability since taking out your original mortgage.

If you are looking to remortgage with only one year’s worth of accounts, it is possible, as the process is similar to obtaining a regular mortgage. The main difference is that lenders will also assess if you have equity in your property to enable you to remortgage or release equity. A good history of mortgage repayments will also show lenders that you can manage your finances and are a reliable borrower.

While it is possible to get a mortgage with only one year’s worth of accounts, you may need a specialist lender or expert Mortgage & Protection Adviser to assist you. This is because lenders need to minimise risk and be confident that you can make your repayments.

If you have less than three years’ worth of accounts, some lenders may feel that there is not enough background information to thoroughly assess your business, or that your income is not stable enough to meet repayment obligations.

Using a specialist self-employed mortgage broker, such as Mortgage Decisions, can be beneficial in many ways. They can ensure that you have all the necessary documentation and evidence for your mortgage application and submit your details to lenders who are most likely to approve your application. This saves you time and avoids multiple declines, which can also affect your credit rating.

Before the 2007 credit crunch, lenders allowed self-employed borrowers to ‘self-certify’ their mortgage applications. This meant that self-employed individuals could state their annual income without providing any documents to prove their income source or stability.

However, since 2011, self-certified mortgages have been banned due to many borrowers being approved for mortgages they could not afford. Today, lenders must run affordability checks before offering any mortgage, and self-certification of income is not allowed.

Today, most lenders prefer self-employed mortgage applicants to have at least two years’ worth of accounts. The more financial history and stability you can demonstrate, the better your chances of being approved. Some lenders may still consider applicants with only one year’s worth of accounts, but there are only a few who can help with this.

Many self-employed mortgages now require a copy of your SA302 form, which can be obtained from HMRC’s online portal or by requesting a copy by mail.

Some lenders may also ask for additional evidence, such as a reference from a qualified accountant or finalised accounts, to accurately assess affordability.

At Mortgage Decisions, we specialise in these types of mortgages, so even if you have been declined in the past, our expert mortgage and protection advisers can help you find a specialist lender who accepts less financial history than high street lenders.

When lenders consider mortgage applicants, they are primarily concerned with your ability to afford repayments for the duration of the mortgage term. Therefore, as long as you can prove a sustainable income from your business, lenders are not usually concerned about the nature of your business.

Lenders are responsible for assessing affordability, not judging your business model or industry, except in specific circumstances.

As with any mortgage or loan, the amount you can borrow will depend on the risk you pose to the lender. Factors such as your income, expenses, credit score, and other relevant information will be considered. In general, lenders will base their decision on your net income.

Yes, it is still possible to get a mortgage even with 1-years’ accounts and bad credit, but it will likely be more challenging and come with some drawbacks.

Lenders rely on your past financial behaviour to assess risk. With only 1 year’s accounts, they have less information to judge your income stability and responsible credit management.

A bad credit score indicates a history of missed payments or debt problems. This makes you a higher-risk borrower in the eyes of lenders, making them less likely to approve your mortgage application.

Consider working with a specialist mortgage broker like Mortgage Decisions. We cater to borrowers with bad credit or limited account history. We can search for lenders meeting your criteria that are willing to consider your situation, especially if you have a good explanation for the bad credit.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

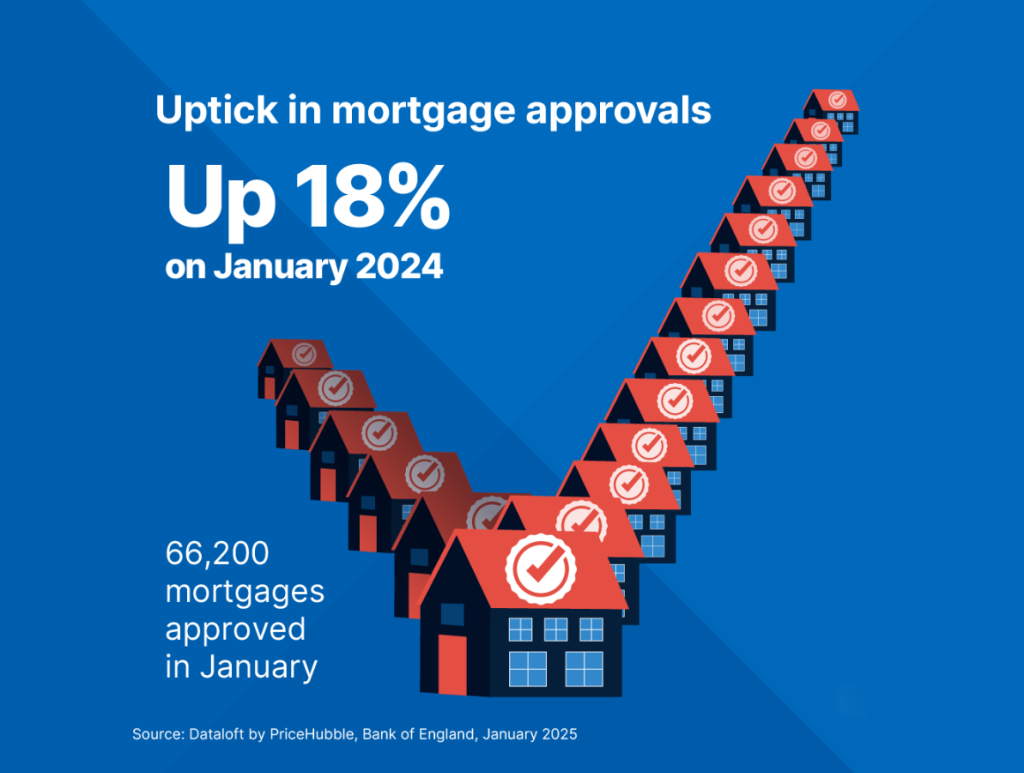

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

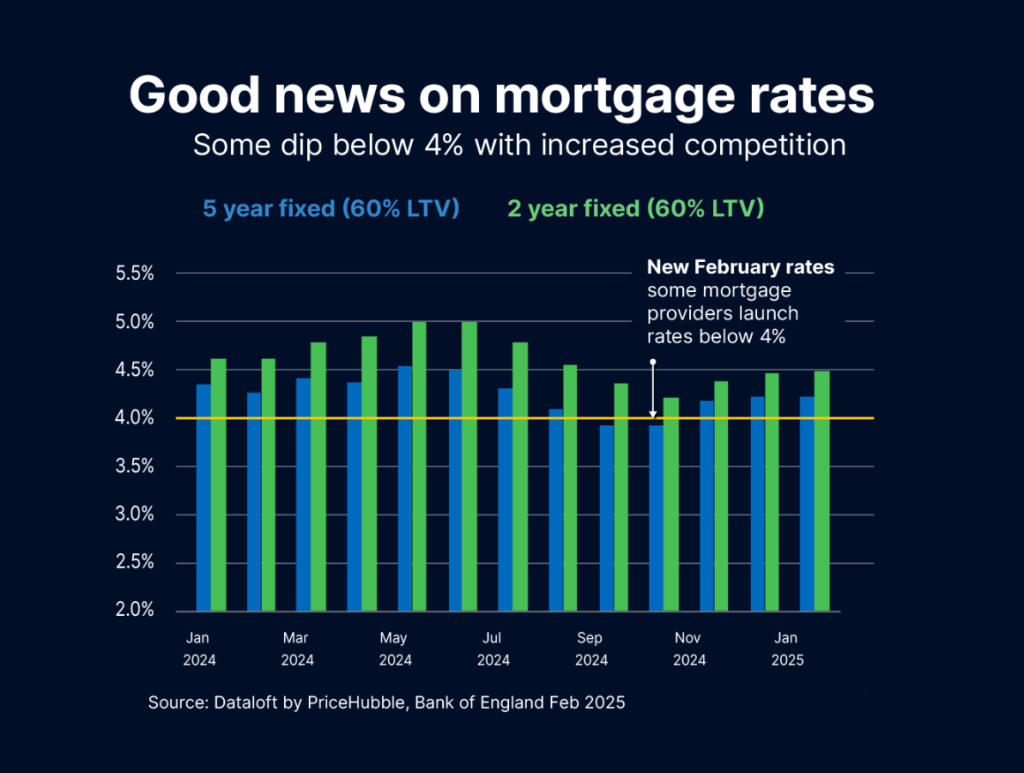

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…