- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

A Whole of Life Insurance policy ensures that your loved ones will receive a lump sum payout upon your passing. This coverage remains intact throughout your lifetime, hence the term ‘whole life’ insurance.

It’s important to note that whole life insurance is a form of life assurance, guaranteeing a payout as long as premiums are consistently paid. Keep reading to delve deeper into the specifics of Whole of Life Insurance, including its cost and how to obtain this policy type.

Whole of life insurance operates as follow:

Upon application, a specific cover amount is determined, leading to the calculation of your monthly life insurance premiums.

These premiums will be sustained throughout your lifetime. In the event of your passing, your beneficiaries can claim on your policy to receive a lump sum payout.

It’s important to note that failure to continue premium payments will result in the termination of your cover, leading to no payout issuance.

Whole-of-life insurance presents an excellent choice for individuals seeking to secure a lasting inheritance for their loved ones. As individuals advance in age, opting for a Whole-of-life insurance policy enables them to allocate a more substantial amount compared to an over 50s plan.

Typically, over 50s plans confine the sum assured within a range of £10,000 to £20,000, while Whole-of-life insurance opens doors to coverage extending up to £1,000,000, empowering you to bestow a more substantial inheritance and safeguard various financial obligations for your beneficiaries.

Moreover, individuals in good health stand to benefit from more competitive premiums, as insurers consider your medical details during application to determine your monthly premium accurately.

To explore whether Whole-of-life insurance aligns with your needs, reach out to our knowledgeable team members. Contact us today for expert guidance tailored to your unique circumstances.

Whole of life insurance premiums are determined by essential factors such as the coverage amount (sum assured), age, health, smoking status, medical history, and pre-existing conditions, much like standard life insurance policies.

Given the guaranteed payout, whole of life insurance typically commands higher premiums compared to term-based coverage.

In some instances, these policies may have a specified upper age limit, usually around 85-90, after which premium payments cease while the coverage persists. Please note that this limit can vary among providers.

Whole of life insurance provides a guaranteed pay-out to your beneficiaries after your passing.

It can be used to cover funeral costs, provide an inheritance for loved ones, support future living expenses, and more.

It offers financial protection and flexibility for your beneficiaries.

You have provided a clear distinction between two main types of whole of life insurance: investment and non-investment policies.

Investment whole of life policies link part of your premiums to investments, potentially affecting the final amount received by beneficiaries.

Non-investment policies involve fixed premiums and a guaranteed pay-out to beneficiaries upon the policyholder’s passing.

Whole of Life Insurance can be obtained jointly, covering two lives under one policy to save costs. With a single application and premium, there’s one pay-out after the first death.

However, this may leave the surviving partner seeking new coverage at an older age with higher premiums.

While joint policies offer savings, individual policies provide more extensive coverage. If a joint whole of life policy aligns with your budget, contact us for a detailed single versus joint life insurance comparison with a professional approach.

Unfortunately, critical illness cover cannot be incorporated into a Whole of Life Insurance policy for comprehensive protection. However, you can opt for a standalone critical illness cover policy to ensure you have this specific coverage.

This would entail paying two separate premiums, potentially making it a more expensive choice. Critical illness cover offers an additional layer of security by providing a pay-out upon diagnosis of a serious illness listed in your policy.

These funds can be utilised for medical expenses, income replacement, or caregiver costs.

For individuals in their 50s and above, securing financial protection is vital. While some plans require lifelong premium payments, certain providers offer coverage without ongoing premiums after a certain age. Your choice between the two hinges on your unique circumstances.

An over-50s plan offers guaranteed acceptance for those facing health challenges within the age group.

Conversely, individuals in good health might prefer Whole of Life Insurance for a higher payout.

Whole of Life Insurance for over 50’s:

Consulting with a specialist like Mortgage Decisions can guide you towards the most suitable coverage. Reach out to us to compare various policies tailored to your needs.

You can also enhance your coverage by adding a Funeral Plan.

Benefits of Funeral Plan:

Consider securing a Whole of Life Insurance policy and a Funeral Plan concurrently, if feasible within your budget.

With the Whole of Life Insurance you will leave an inheritance for your family’s discretion.

By adding a Funeral plan you have a guaranteed prepayment and arrangement of your funeral.

For insurance business we offer products from a choice of insurers.

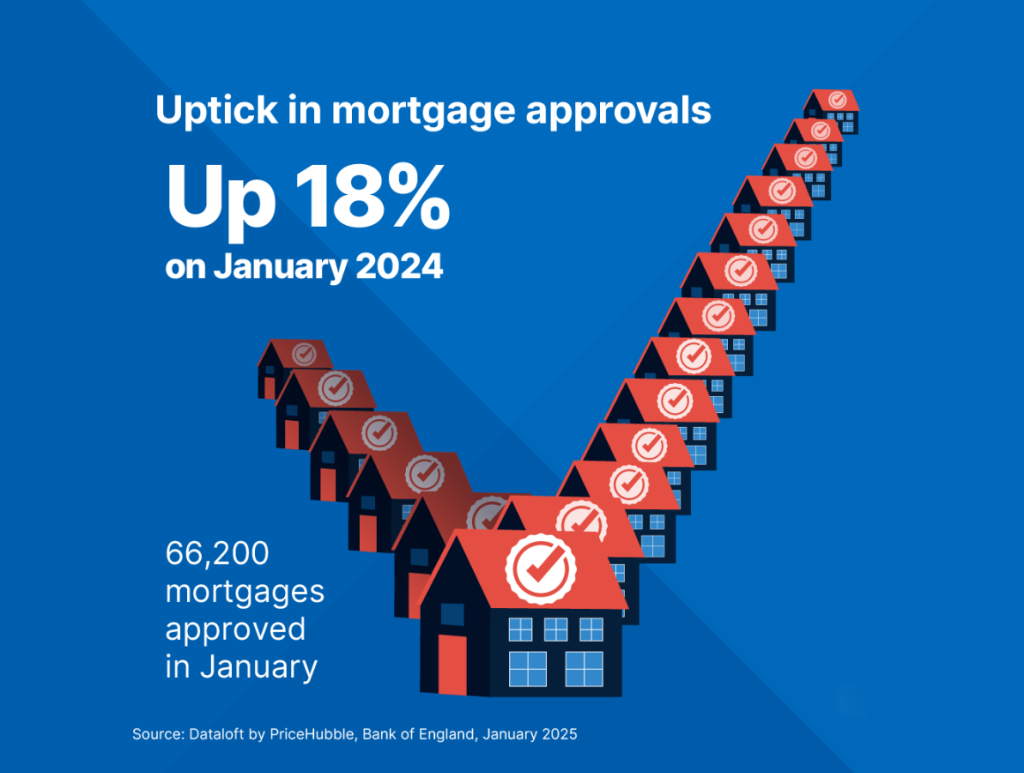

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

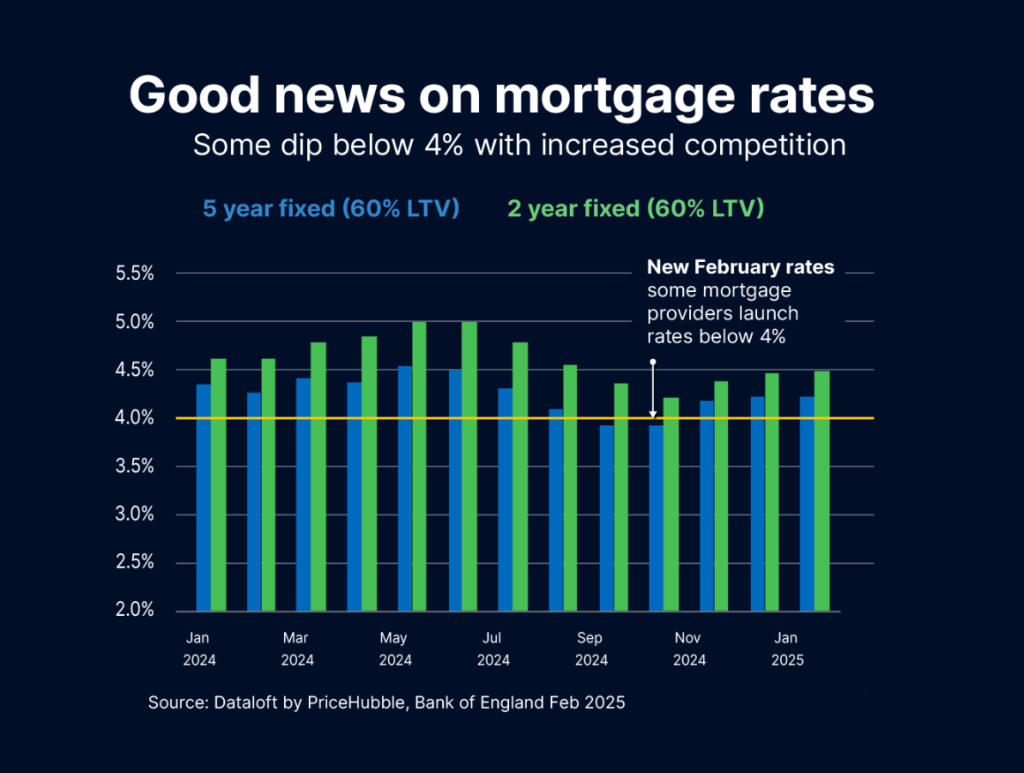

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…