- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Facing time off work due to illness or injury can be challenging, especially if your savings or sick pay fall short. Short-term income protection steps in to ease this burden. This insurance offers temporary financial support by replacing a portion of your monthly income. In the event of illness, injury, or even redundancy, short-term income protection can provide a crucial safety net for a period ranging from six months to two years, depending on your chosen provider.

This policy ensures you receive tax-free monthly payments, typically covering 50% to 70% of your usual income, for a duration of six to 24 months – with some policies extending up to five years. Whether you’re battling back pain, recovering from an injury, or facing mental health challenges like depression or anxiety, this protection bridges the financial gap until you’re ready to return to work or until the policy period expires.

The flexibility of short-term income protection allows you to utilise the funds as needed – whether it’s for mortgage payments, household bills, childcare expenses, debts, transportation costs, or daily essentials. It acts as a crucial buffer during unexpected health setbacks or job loss, offering peace of mind and financial stability in uncertain times.

While long-term income protection secures your financial well-being until retirement, a short-term policy is tailored to provide support for a limited duration, typically between six months and two years. Although designed to cover you until you can resume work, in the case of prolonged illnesses or severe injuries, the payment period may conclude before full recovery.

It’s worth noting that short-term income protection policies can be claimed more than once, ensuring continued support if you face recurring health challenges. The monthly payments, covering a percentage of your gross salary, are tax-free and kick in after a specified deferral period – typically ranging from four weeks to 12 months. Choosing the right deferral period is crucial, balancing the cost of premiums with your financial needs during the waiting period.

Providers offer different types of income protection policies, catering to various needs:

While short-term income protection offers valuable support, there are exclusions to be aware of, including pre-existing conditions, injuries from criminal activities, and voluntary redundancy. For self-employed individuals, this protection is available based on average earnings, helping cover essential expenses during periods of inability to work.

In conclusion, short-term income protection serves as a vital lifeline during challenging times, providing financial stability and peace of mind as you navigate unexpected health setbacks or job loss.

For insurance business we offer products from a choice of insurers.

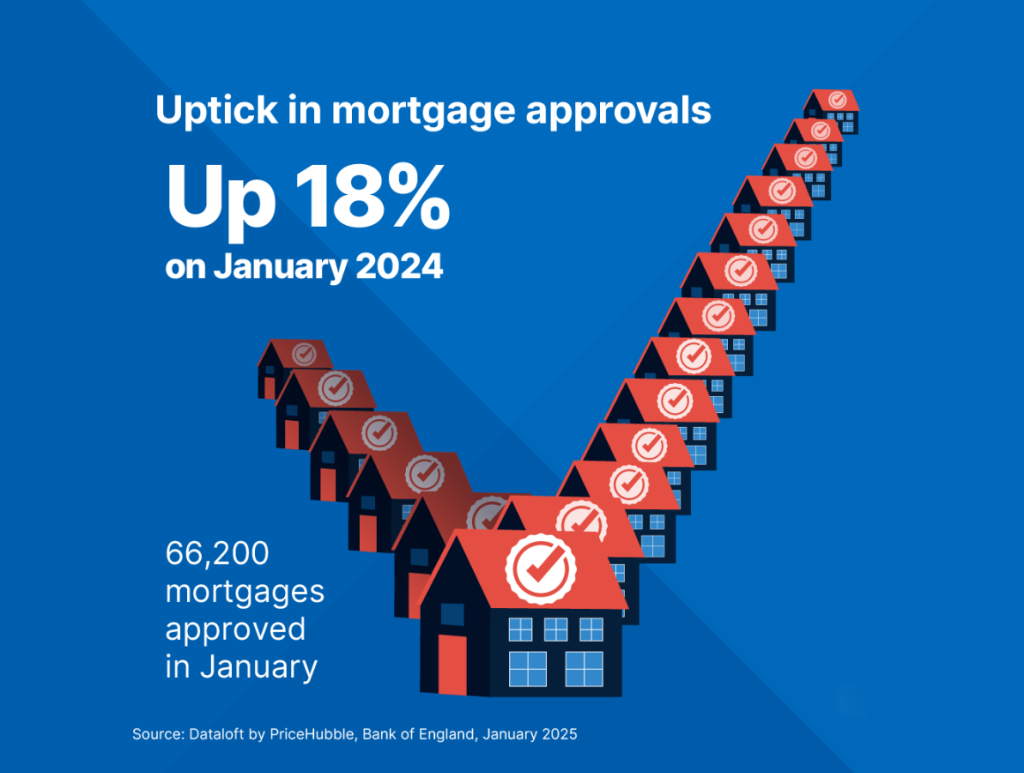

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

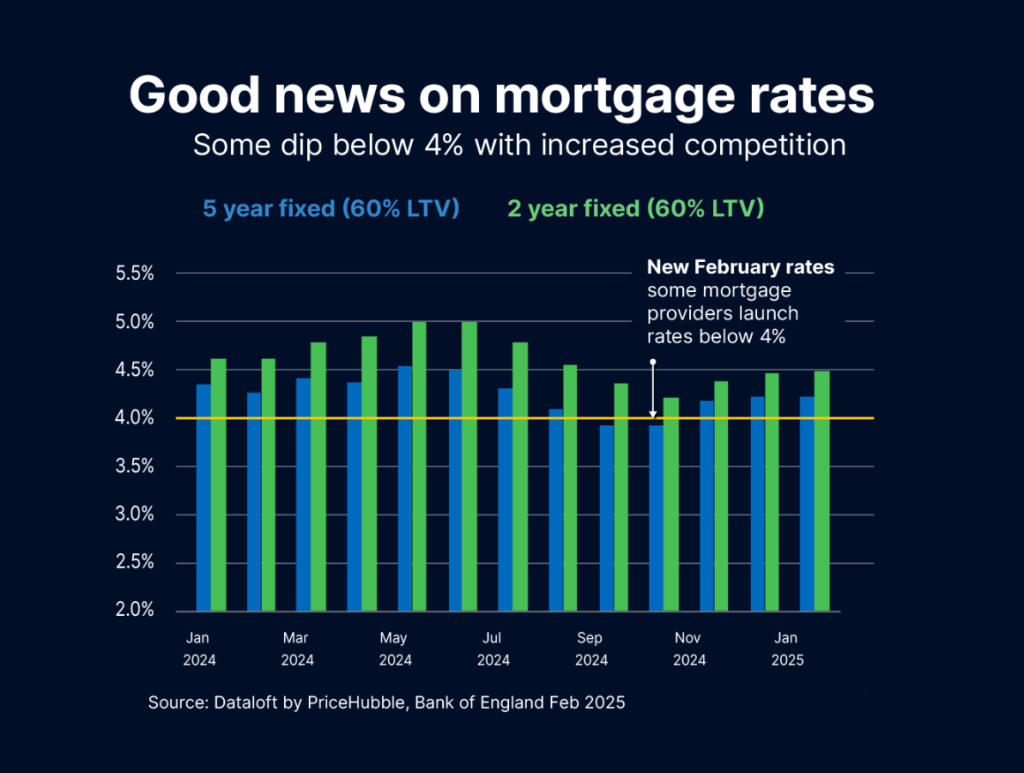

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…