- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Life insurance for self-employed individuals is essential, regardless of whether you work for an employer or for yourself. The type of occupation you have only becomes a factor in your life insurance coverage if you are involved in a high-risk job.

Self-employed individuals opt for life insurance for various reasons, and the available options are no different from those offered to employees. Ensuring adequate life cover is crucial for anyone with dependents, such as a partner or children.

Unlike employees who may receive death in service benefits, self-employed individuals do not have this financial security net. In the event of their passing, their loved ones may face financial difficulties. Life insurance for self-employed individuals provides a cash lump sum to help support their family members during such challenging times.

While employees may rely on death in service benefits to supplement their life insurance needs, self-employed individuals must carefully assess the appropriate amount of coverage required to safeguard their loved ones.

Consider your specific circumstances and the aspects of your life you wish to protect when determining the amount of life insurance you need. This may include childcare costs, family living expenses, funeral costs, inheritance, mortgage debts, outstanding loans, rental expenses, and your self-employed income.

Various life insurance policies cater to different needs, such as term-based life insurance, family income benefit, whole-of-life insurance, and over-50s plans. Additionally, consider supplementary coverages like terminal illness cover, critical illness cover, income protection, and health insurance to enhance your financial protection.

Term-based life insurance provides coverage for a set period, with a pay-out to beneficiaries if the policyholder passes away during that timeframe. Level term life insurance offers a consistent pay-out value throughout the policy term, suitable for covering fixed costs like mortgages, living expenses, funeral expenses, or providing an inheritance.

On the other hand, decreasing term life insurance provides a lump sum that decreases over time, making it ideal for protecting a repayment mortgage as the sum assured aligns with the remaining mortgage balance. This type of cover is cost-effective as well.

Over 50 life insurance provides lifelong coverage and guarantees acceptance for UK residents aged 50 to 85 without the need for medical information. This option can be beneficial for self-employed individuals in this age group who have faced challenges obtaining coverage due to health issues. However, the sum assured is typically lower than other policies as the insurer faces unknown risks, often capped at £20,000.

It’s important to note that there may be a waiting period added to your policy, meaning no pay-out within the first 12 to 24 months if you pass away. In such cases, any premiums paid will be refunded to your beneficiaries. Considering that the most common age bracket for self-employed workers is 45 to 54, individuals in their 50s may want to explore alternative coverage options to ensure comprehensive protection.

Whole of life insurance offers lifelong coverage and guarantees a pay-out to your beneficiaries upon your passing, providing financial support for funeral expenses, ongoing family living costs, or inheritance purposes. This type of coverage is more suitable for individuals in later stages of life who are in good health, as premiums need to be paid until the insured individual’s passing.

Family income benefit is a term-based policy that offers tax-free monthly payments to your loved ones in the event of your passing during the policy term. These payments continue until the policy’s conclusion, making it ideal for replacing your self-employed income and assisting with long-term financial planning.

Critical illness cover provides a lump sum payout upon the diagnosis of a serious illness listed within the policy, helping to replace lost income or cover medical expenses. This can be added to a life insurance policy for an extra fee or purchased separately through certain providers.

Income protection insurance offers financial support if you are unable to work due to illness or injury, ensuring essential income for self-employed individuals during periods of incapacity. While this policy cannot be combined with life insurance, both can be purchased concurrently to create a comprehensive coverage solution.

Regarding smoking and its impact on self-employed life insurance, it’s important to note that smoking, vaping, e-cigarettes, and other nicotine products can influence policy pricing based on factors such as smoking history, frequency, medical complications, and other risk factors. While smokers may face higher premiums, it’s still possible to obtain coverage despite smoking habits.

When considering whether to write your self-employed life insurance in trust, keep in mind the potential benefits this option offers. By placing your policy in trust, you can reduce or avoid inheritance tax, expedite the pay-out process for your beneficiaries by bypassing probate, and exercise greater control over how the funds are distributed according to your wishes.

The specific insurance needs for self-employed individuals vary based on their respective industries, so it’s essential to maintain a professional and informative tone when discussing insurance options.

For insurance business we offer products from a choice of insurers.

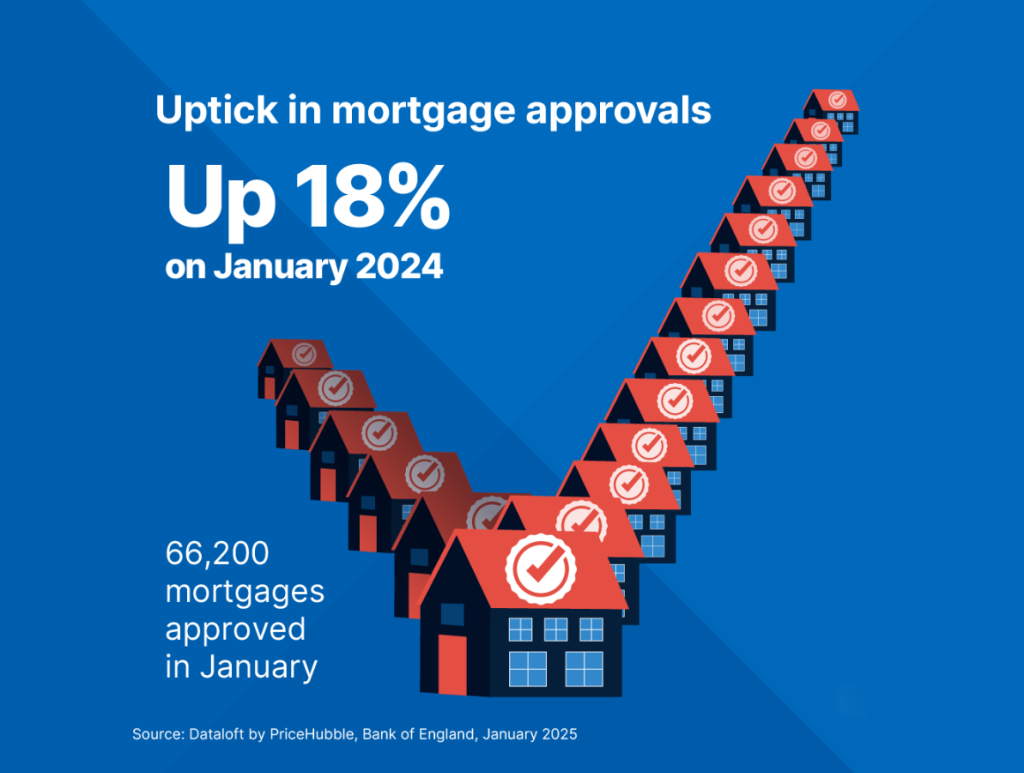

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

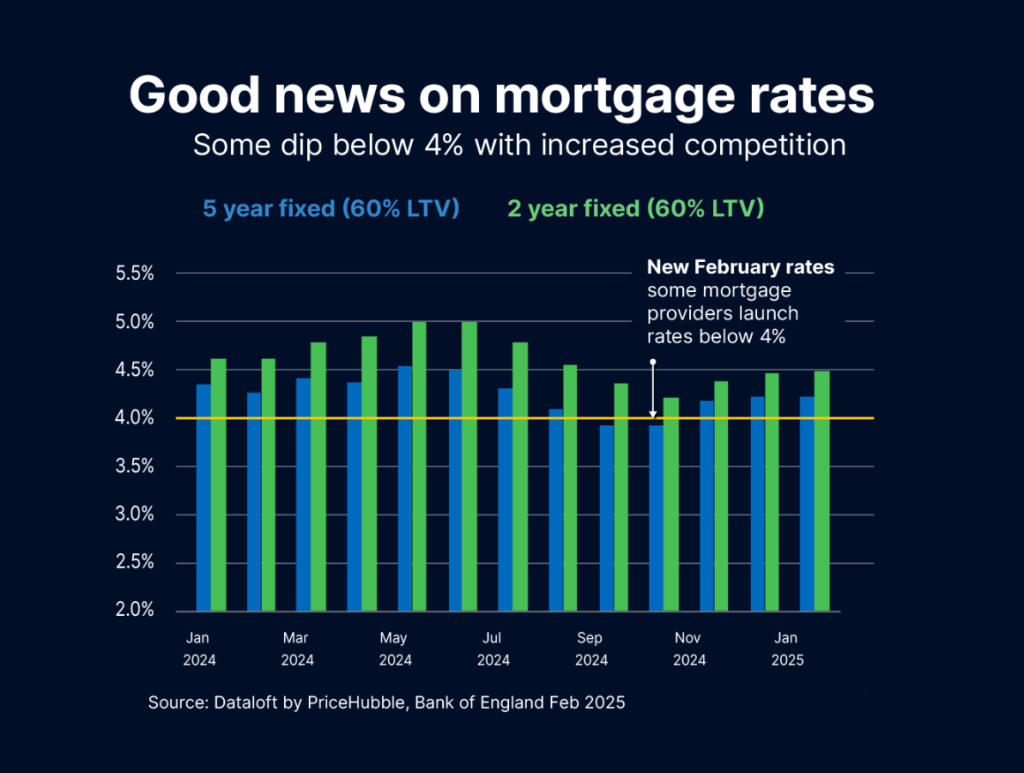

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…