- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Life insurance is a vital tool for parents in the UK looking to secure their children’s financial future. While the cost of raising a family can be steep, prioritising this essential protection is crucial. We understand that budgets may be stretched thin, which is why we offer a free quote for life insurance tailored specifically for parents.

Whether you are a new parent or have adult children, life insurance offers a cost-effective means of safeguarding your family’s financial well-being. The benefits from a life insurance payout could become essential in the future by assisting with:

Lacking this protection could burden your loved ones with significant financial responsibilities. Fortunately, there are numerous affordable policy options to choose from.

Determining the appropriate amount of life insurance for your needs is a crucial step in safeguarding your financial future. The necessary coverage will vary depending on what you intend to protect.

To calculate the ideal coverage, it’s essential to consider all financial aspects you wish to provide for. This may include covering outstanding mortgage payments, family living expenses, funeral costs, and university fees, among others. By totalling these expenses, you can determine the sum assured for your life insurance policy.

Welcoming a new baby into your life can be a powerful reminder of the importance of securing your family’s future, even in the face of life’s uncertainties. That’s why many new parents consider getting life insurance as a crucial step during this transformative time. We understand that balancing new expenses with planning for the unexpected can be challenging. Our team is here to help you navigate your options and find a solution that fits your budget and priorities.

Don’t hesitate to reach out today to request your complimentary quotes and take the first step towards protecting your growing family.

Here are some enhanced tips for new parents considering life insurance:

Compare quotes from multiple insurance providers to ensure you secure the best deal possible for your family’s needs. We can do this for you.

Choose a policy that suits your specific requirements to avoid paying for unnecessary coverage that may not benefit your loved ones in the long run.

Determine the precise amount of coverage you need based on your family’s financial situation and future needs. This way, you won’t end up overpaying for more coverage than necessary.

Embracing a healthy lifestyle not only benefits your well-being but can also help reduce insurance premiums.

Choosing the right life insurance for parents is crucial in safeguarding your family’s future. Your ideal policy will vary based on your unique circumstances and the specific areas of your life you aim to protect.

The monthly premiums you pay are determined by the level of risk you present to the insurance company. This risk assessment considers several key factors, including your age, current health status, medical history, smoking habits, desired coverage amount, and the type of policy you select.

Different types of life insurance policies are designed to cover specific aspects of your life. It’s essential to select a policy that aligns with your financial capabilities and provides the necessary protection for your family.

Fortunately, you have a variety of policy options at your disposal to choose from. Take the time to explore these options and find the best life insurance that suits your needs and budget.

Term life insurance is a popular choice among new parents, offering coverage for a specific period. In the event of your passing during this term, a payout will be provided to your beneficiaries.

There are two main types of term life insurance: level and decreasing.

Level term insurance offers a consistent lump sum payout, making it suitable for covering expenses that remain constant in value, such as an interest-only mortgage, inheritance, or daily living costs like childcare.

On the other hand, Decreasing term insurance provides a lump sum payout that decreases over the policy term. This type of insurance is best for covering expenses that diminish over time, like a repayment mortgage.

Family Income Benefit offers a unique advantage compared to traditional term life insurance by ensuring your family receives a continuous, tax-free income stream instead of a lump sum payout.

With coverage for a specified term, should the unforeseen happen during this period, your family will receive ongoing payments until the term concludes. This proactive approach can effectively replace lost income and safeguard your family’s standard of living.

Consider complementing your existing term cover with a Family Income Benefit policy to enhance your family’s overall protection.

This form of life insurance is often one of the most cost-effective options due to reduced risk for insurers over time. Additionally, it simplifies financial planning by alleviating the need for complex investment decisions associated with traditional life insurance products.

Joint life insurance for parents is a convenient and cost-effective way to protect both individuals simultaneously, offering an average savings of 25% compared to maintaining two separate policies.

This option is particularly popular among young parents seeking financial security for their families. In the unfortunate event of one parent’s passing, the surviving partner will receive a single payout, which can provide crucial support for the family’s needs.

It’s important to note that joint life insurance typically ceases upon the first policyholder’s death, potentially leaving the surviving partner vulnerable and in need of alternative coverage in the future. Considering that ongoing financial protection for your children is essential, especially as they grow older, it may be prudent to weigh the benefits of individual policies.

Opting for two separate policies could offer the advantage of potential dual payouts, thereby providing enhanced coverage for your loved ones. Consider your budget and long-term needs carefully when deciding on the best insurance strategy for your family’s well-being.

The cost of life insurance is calculated based on the level of risk you pose to an insurer.

They take into account your age, health, whether you smoke, and amount/type of cover to determine the likelihood of a claim. Parents who pose a high risk will pay a higher monthly premium than their less risky counterparts.

Many insurers in the market have recently introduced a beneficial offer of complimentary life insurance for new parents.

This coverage is valid for the first year of your child’s life and typically provides each parent with a £10,000 sum assured. While this may initially appear advantageous, it’s essential to recognise that £10,000 may fall short in adequately safeguarding your family in the event of a tragedy.

Considering factors such as mortgages, debts, childcare expenses, and daily living costs, it becomes evident that this £10,000 coverage could quickly deplete. Therefore, to ensure your family is adequately protected, it is advisable to secure standard life insurance with a more substantial sum assured to meet your family’s true coverage needs.

Determining the appropriate duration for your life insurance coverage is crucial and should align with the specific needs you aim to safeguard.

For instance, matching the term of your decreasing term policy with the duration of your mortgage can be a strategic choice. This strategy safeguards your most valuable asset – your home – and provides stability for your family, eliminating the need to uproot their lives.

Alternatively, you can base the length of your policy on the age of your children. This approach ensures that you have sufficient coverage to secure their financial well-being until they reach independence.

It’s also wise to anticipate the potential scenario where your children pursue higher education, potentially requiring financial assistance for an extended period. This foresight allows you to plan for their needs comprehensively. By tailoring the duration of your life insurance coverage to your specific circumstances, you can provide a secure financial future for your loved ones.

It is worth noting that some life insurance policies can be adapted if your personal circumstances change. Having more children or moving to a larger home are two instances where a special event option can be triggered.

This is when the sum assured can be increased without the need for additional underwriting. (Although, this increase will be reflected in the cost of your premiums). If a special event option isn’t available, you could cancel your existing cover and take out a new policy.

Alternatively, you could keep your existing policy and take out a second policy to bridge the cover gap.

A common misconception persists that life insurance is only essential for working parents who earn a salary. However, in the event that a two-parent household suddenly becomes a single-parent one, the surviving parent is likely to encounter numerous challenges.

These challenges may include the need to reduce working hours to care for the children or the burden of costly childcare expenses. Now, envision the financial and practical consequences if that stay-at-home parent were no longer present. Therefore, it is prudent for both parents to consider securing life insurance to safeguard their family’s future.

For insurance business we offer products from a choice of insurers.

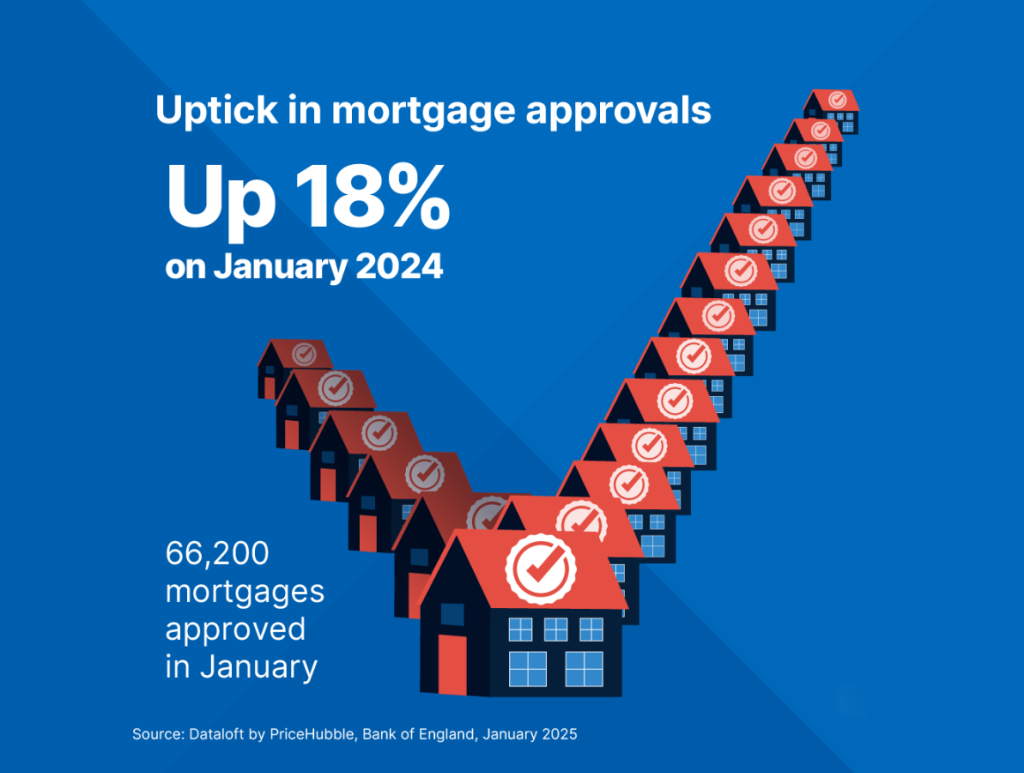

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

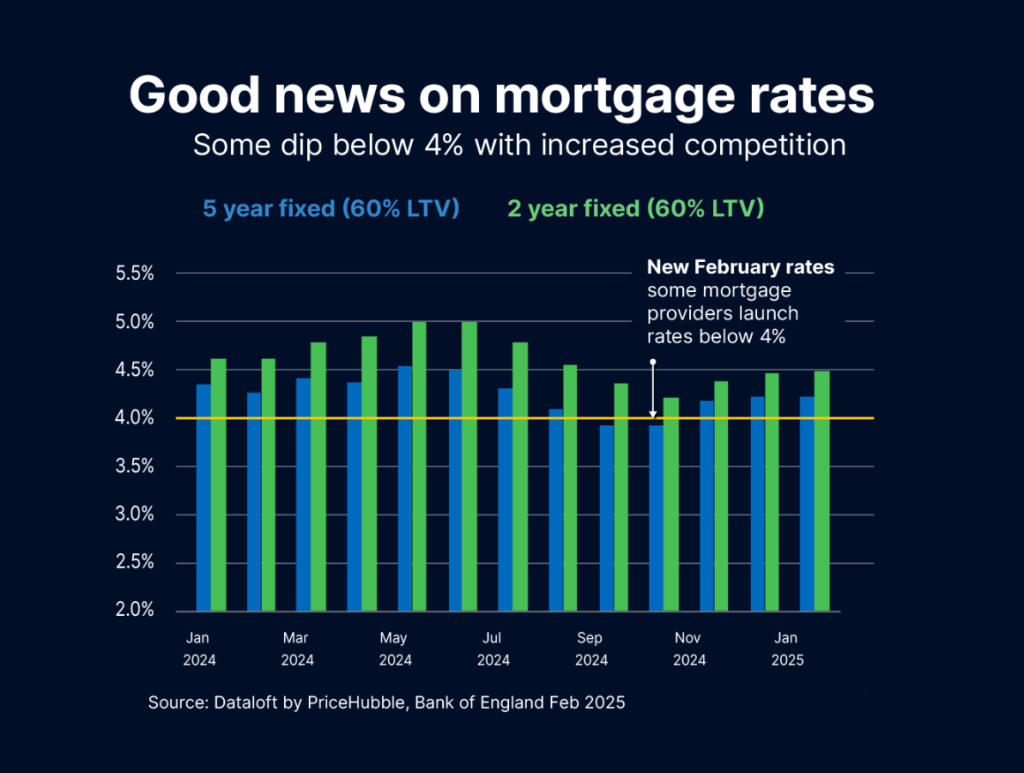

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…