- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Ensuring financial security for your loved ones in the event of your untimely passing is a vital aspect of responsible financial planning. Life insurance plays a crucial role in guaranteeing that your dependents are not left in a precarious financial situation. Additionally, it can serve as a means to settle outstanding mortgages, providing peace of mind for you and your family.

As you approach your 50s, your financial obligations may shift, with fewer dependents and a potentially reduced mortgage balance. However, the need for life insurance may still be relevant for various reasons. This is where over-50s life insurance comes into play, tailored for individuals aged 50 to 80 (with some plans extending to 85) to mitigate the financial impact of your passing on your loved ones.

Deciding whether over-50s life insurance is the right choice for you hinges on your specific circumstances and objectives for procuring coverage. These policies typically offer a fixed cash lump sum payout upon your demise, irrespective of the duration of the policy.

When contemplating life insurance, it’s essential to clarify your objectives. Are you seeking to provide ongoing support for young adult children who may still rely on you financially? Or perhaps you aim to ensure that your spouse maintains a comfortable standard of living after your passing?

Moreover, life insurance can also be utilised to cover funeral expenses promptly, circumventing delays associated with the inheritance process. By determining the lump sum amount, you will establish a corresponding monthly premium. It’s crucial to select a premium amount that aligns with your budget and is sustainable over the long term to prevent financial strain.

Providers may offer either fixed or increasing life insurance plans, with premiums and payouts adjusted accordingly. Understanding the terms of your policy is essential before finalising your decision.

Advantages of over-50s life insurance include guaranteed acceptance for individuals aged 50 to 80, eliminating the need for medical tests. The fixed payouts and monthly instalments facilitate effective financial planning, affording clarity on the benefits your loved ones will receive. Additionally, the flexibility to allocate the pay-out as desired offers added convenience.

However, it’s important to note potential drawbacks, such as waiting periods of 12 to 24 months before full payouts are disbursed. Non-payment of premiums can result in lapsed coverage, leading to the loss of benefits. Furthermore, the possibility of paying more in premiums than the eventual pay-out underscores the importance of careful consideration before committing to a policy.

In conclusion, exploring the diverse options in over-50s life insurance can help you tailor a plan that meets your specific needs and financial objectives. Whether opting for whole of life, term, guaranteed, fixed, or increasing insurance, understanding the nuances of each type is crucial for making an informed decision that secures your family’s financial future.

For insurance business we offer products from a choice of insurers.

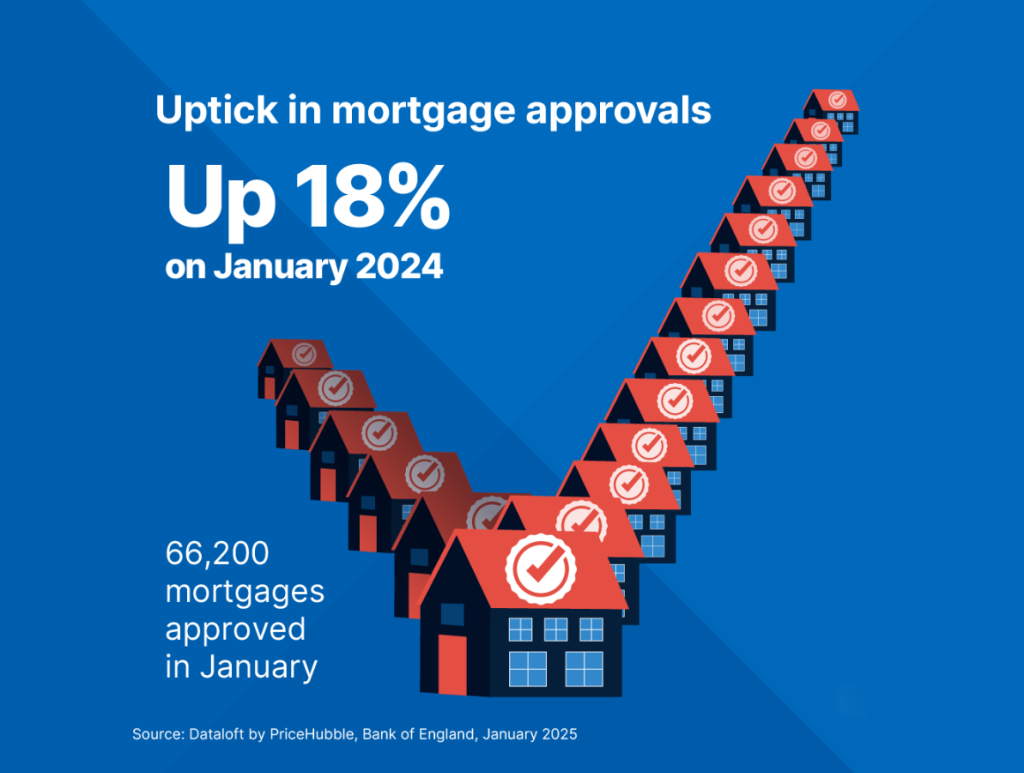

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

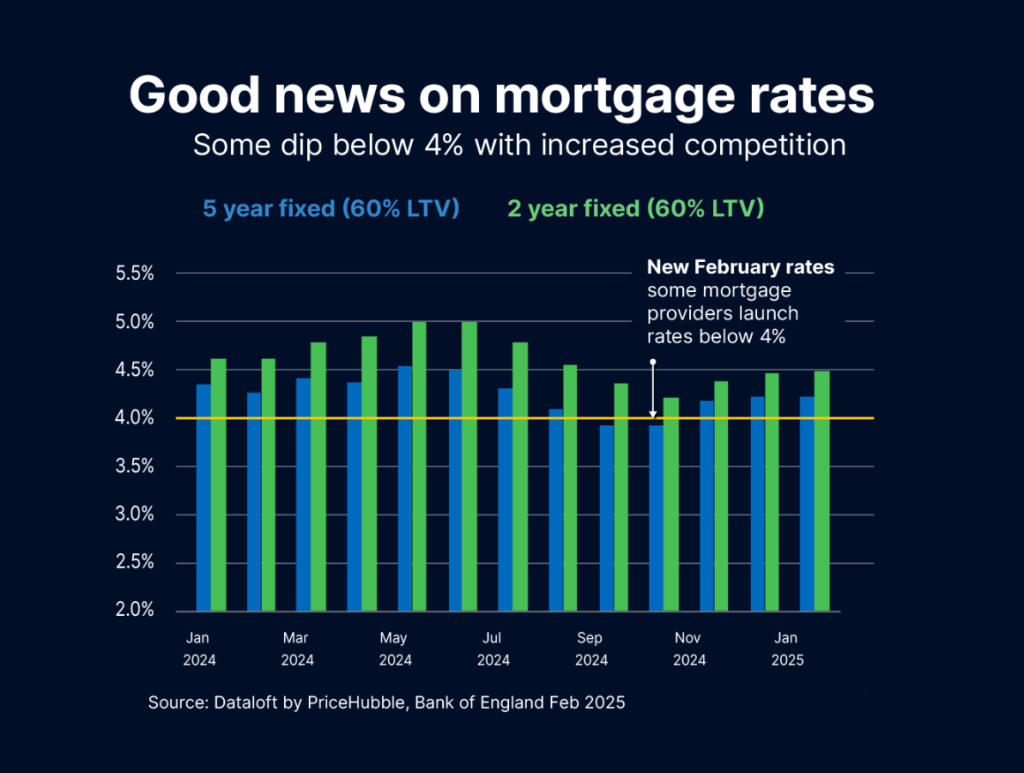

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…