- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

Life insurance for individuals over 40 is a crucial step towards ensuring the financial security of your loved ones in the event of your passing. By securing life insurance during this stage of your life, characterised by stable income, homeownership, and familial responsibilities, you are proactively planning for the unforeseen future challenges.

Consider the peace of mind that comes with knowing your family will be taken care of financially if you were no longer there to provide for them. Securing a life insurance policy in your 40s allows you to lock in reasonable monthly premiums while guaranteeing a lump sum payout to your beneficiaries upon your death.

It is advisable to explore different insurance providers and compare quotes to find the most suitable coverage that meets your needs. Take this opportunity to safeguard your family’s financial well-being by investing in life insurance tailored for individuals aged 40 and above.

Considering life insurance in your 40s can be a wise decision to protect your family’s financial future. Generally, the cost of life insurance is lower when you are younger due to a decreased likelihood of health issues, making your 40s an advantageous time to secure coverage.

In your 40s, you are still relatively young, allowing you to benefit from affordable premiums for term-based coverage. Additionally, whole of life insurance may be a viable and cost-effective option at this age.

Life insurance provides your loved ones with a lump sum payment in the event of your passing, which can help them manage financial obligations and maintain their quality of life. Your insurer will calculate the cost of your premium by using factors such as…

Life insurance is a crucial consideration for parents over 40, especially with the trend of having children later in life becoming more common. In fact, in 2021, the average age of mothers giving birth in England and Wales rose to 30 years old. Becoming a first-time parent in your 40s is no longer unusual, with 1 in 25 births in the UK being to women in their 40s.

The responsibility of parenthood often underscores the importance of safeguarding your family’s financial future in case of unforeseen circumstances. Many parents opt for life insurance policies that extend until their children reach adulthood or achieve financial independence, ensuring their ongoing security during their dependent years.

For parents juggling full-time careers, these figures highlight the significance of securing adequate life insurance coverage to protect their family’s financial well-being.

Joint life insurance for over 40s could save you up to 25% on your premiums when compared with that of two single policies. Joint cover provides protection for two people simultaneously, however, is only available with regards to term-based life insurance. A payout is made upon the first death, at which point the cover expires and the surviving partner is left unprotected and requiring new cover at an older age. This could result in a significant premium increase if the original cover wasn’t arranged until in your 40s.

As a result, to ensure adequate cover, if your budget allows it’s usually more beneficial to arrange two single policies.

There are numerous viable insurance options tailored for individuals in their 40s that can complement your existing policy or serve as an added layer of protection.

Income protection insurance is a valuable policy that provides financial support in case you are unable to work due to injury or illness. This type of policy typically pays out a percentage of your regular income, often up to 70%, to help compensate for lost earnings.

You will receive monthly instalments, which are usually tax-free, to assist with covering your ongoing expenses such as bills, groceries, and rent while you are unable to work.

Securing an income protection policy through a reputable broker, can help you find the best deal tailored to your needs. Their professional expertise can guide you in selecting the most suitable coverage for your circumstances.

Enhancing your term life insurance with critical illness cover is a prudent choice. Although it may result in higher premiums, it offers the valuable benefit of being able to claim a playout in the event of a serious illness diagnosis such as cancer, stroke, or MS.

This playout can be utilised for essential purposes like home modifications, hiring a caregiver, or replacing lost income if you are unable to work. It’s important to note that opting for critical illness cover means that if a claim is made, the life insurance portion of your policy will no longer be active.

For insurance business we offer products from a choice of insurers.

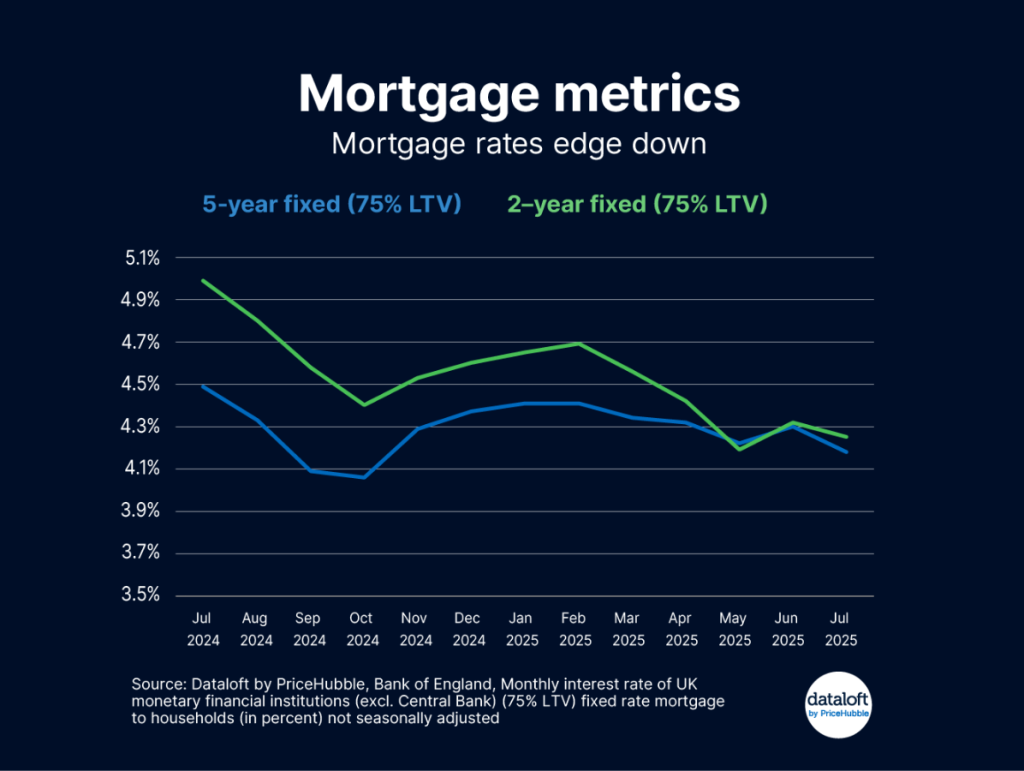

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…