- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

As a father, safeguarding your children is undoubtedly your top priority. One crucial way to achieve this is by ensuring you have the appropriate life insurance coverage in place. Allow us to elaborate on why Life Insurance for dads stands as one of the most significant decisions you can make as a parent.

While fatherhood brings immense rewards, it also presents challenges. Balancing household expenses, mortgage payments, childcare, and daily living costs can be demanding. In the unfortunate event of something happening to you, life insurance can serve as a financial safety net for your loved ones.

Arranging life insurance may not be at the forefront of your mind, especially if you are young and healthy. However, securing life insurance at a younger age is typically more cost-effective, given the lower risk you pose to insurers. This creates an ideal opportunity to protect your family, even as your health may change with age. It is vital to assess the necessary coverage amount and duration. Consider factors such as mortgage obligations, outstanding debts, and the years until your children achieve financial independence.

For single dads, managing various responsibilities such as parenting and work can be overwhelming. Solely shouldering mortgage payments and financial commitments underscores the importance of life insurance for single dads in safeguarding their children’s future. In the absence of your income, an insurance payout could provide essential support. Whether your children are young or swiftly growing up, explore policies that can assist in mortgage repayment or covering educational expenses.

Self-employment offers flexibility and improved work-life balance, yet it lacks benefits like sick pay or income protection schemes. Therefore, having a self-employed life insurance policy is crucial in such circumstances. The right policy can help your family settle the mortgage, meet daily expenses, or fund additional childcare needs.

Additionally, consider supplementary protections like Critical Illness Cover and Income Protection for added financial security in case of severe illness or incapacity to work.

Level Term Life Insurance serves various purposes such as covering the mortgage, bills, living expenses, childcare, funeral costs, or debts. It provides a fixed sum pay-out if you pass away during the policy term.

Decreasing Term Life Insurance is best suited for aiding your family in repaying a mortgage, as the pay-out amount decreases over time in alignment with your mortgage balance.

Whole of Life Insurance ensures a guaranteed payout and remains active as long as you do. It is worth noting that taking out this policy at a younger age may result in contributing more premiums than the eventual pay-out.

Consider whether your family would prefer a lump sum or periodic payments. While most traditional life insurance policies offer a single large sum payout, Family Income Benefit provides regular payments. This structure can assist your family in managing finances effectively and covering ongoing living expenses.

For insurance business we offer products from a choice of insurers.

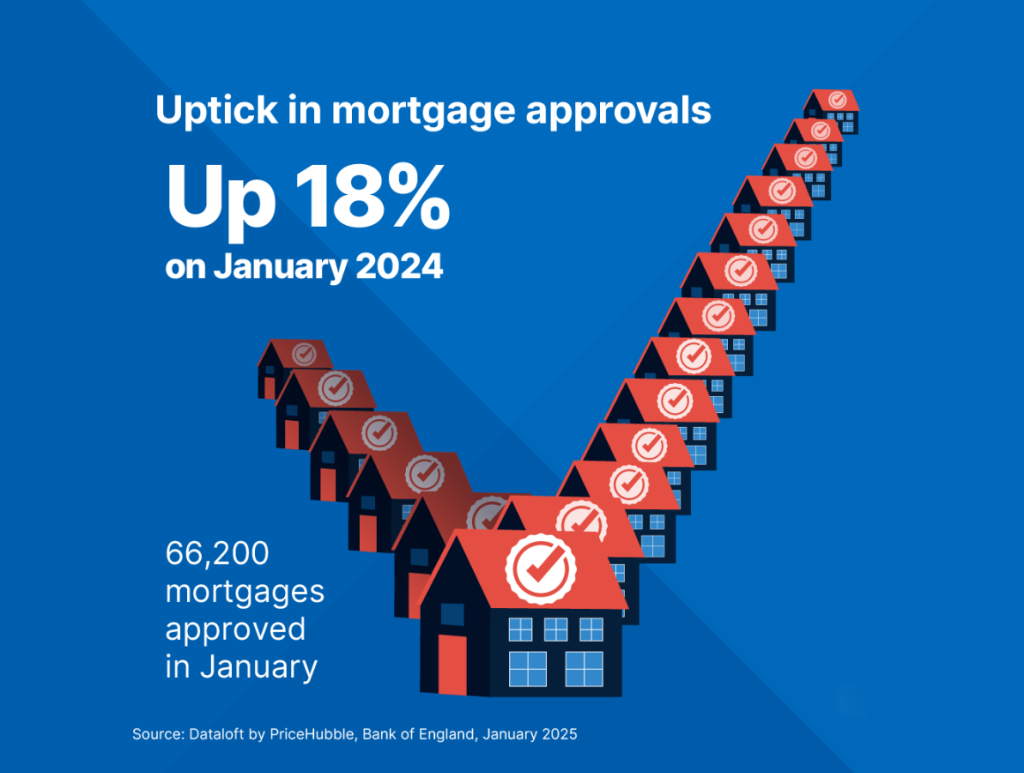

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

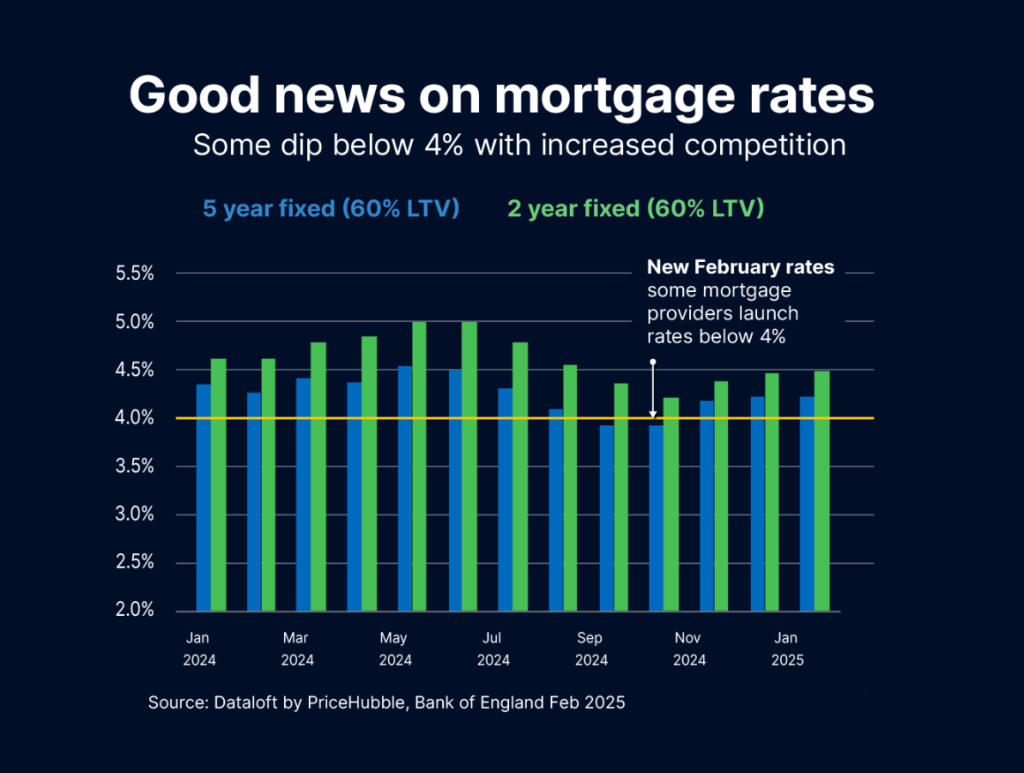

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…