- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

A fixed lump sum cash pay-out for loved ones

Level term life insurance offers your beneficiaries a consistent lump sum payout if you were to pass away during the policy term. Unlike decreasing term life insurance, the pay-out sum remains constant throughout the policy term, ensuring your loved ones receive the same amount regardless of when the unfortunate event occurs.

This stability makes level term life insurance an excellent choice for safeguarding significant expenses for your family. It’s important to note that if you outlive the policy term, no payout will be issued to your beneficiaries.

A level term life insurance policy provides coverage for a specified duration (the term) and guarantees a fixed payout in the event of your passing during that term.

A level term life insurance pay out could help to:

By adding together your key expenses, you can estimate how much you’ll need for your sum assured.

When applying for a policy, you can easily do so by phone or email.

Once established, your policy remains active for a specified period (typically up to 40 years, depending on your circumstances). In the event of your passing during this period, a predetermined lump sum payment will be disbursed.

To maintain your coverage, you must make regular monthly payments, known as life insurance premiums.

Should you pass away within the policy term; your beneficiaries can file a claim. This process involves completing a claims form and submitting a death certificate to the insurer.

Upon approval of the claim, your beneficiaries will receive the lump sum payment. This financial assistance can support them in meeting essential financial obligations and other significant expenses.

It’s crucial to note that if you outlive the policy term, no payout will be issued, and your beneficiaries will not be able to make a claim after the policy has expired.

When calculating the appropriate amount of level term life insurance you require, it is crucial to assess the necessary funds your loved ones would require to manage essential expenses in your absence.

The cover offered can vary between insurers, making it important to compare multiple quotes to ensure you’re getting the right cover for your needs.

The best level term life insurance to meet your needs will be the policy that offers the level of cover over the right term length.

However, the exact price you pay for level term life insurance will depend on your personal circumstances.

When applying for cover, insurers will take key information into consideration when calculating your monthly life insurance premium.

The information required during the application process includes:

In level term life insurance, the sum assured remains constant over the policy term, resulting in slightly higher premiums compared to decreasing term life insurance, where the risk to the insurer decreases.

Despite this, level term life insurance remains one of the most cost-effective coverage options available.

Are you considering level term life insurance with critical illness cover? Absolutely, you can enhance your level term life insurance policy by including critical illness cover for an extra fee.

When integrated into your life insurance policy, critical illness cover enables you to file a claim upon diagnosis of a severe, yet not life-threatening, illness. Alternatively, your beneficiaries can make a claim in the event of your demise.

In situations where your health condition impedes your ability to work, the financial support from critical illness cover can help replace lost income or finance private medical care.

Typically, critical illness cover includes protection against 30 illnesses such as heart attacks, strokes, and certain types of cancer. However, the extent of coverage may vary depending on the insurer.

Level term life insurance advantages and disadvantages. Advantages include:

Level term life insurance advantages and disadvantages. Disadvantages include:

For insurance business we offer products from a choice of insurers.

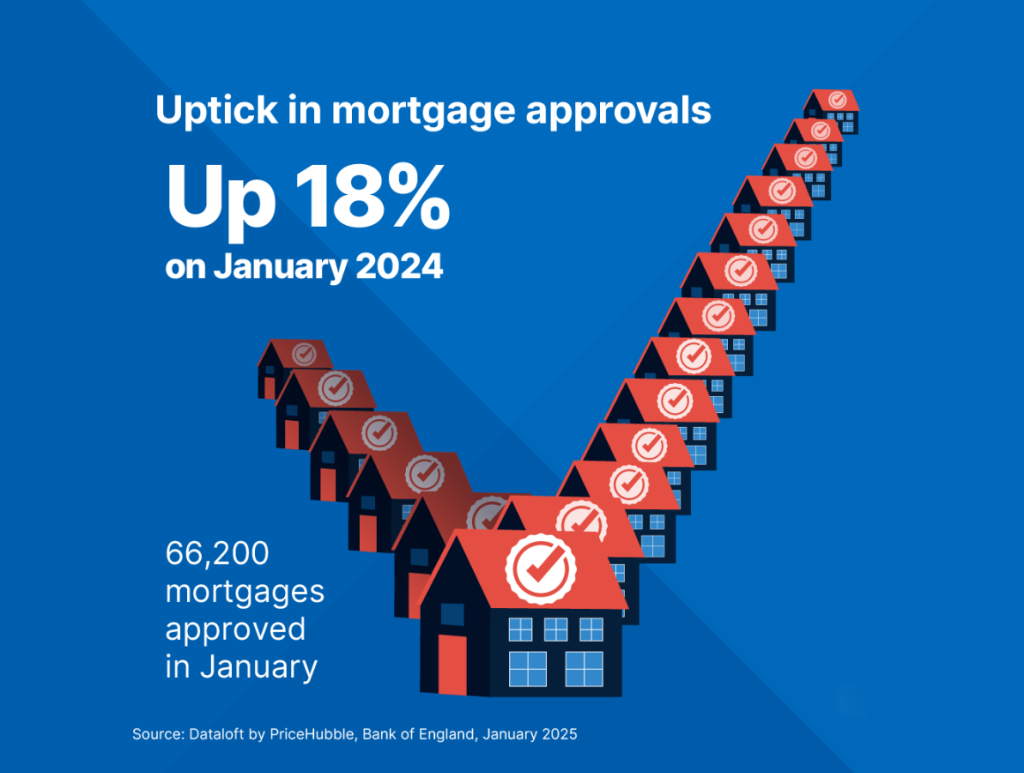

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

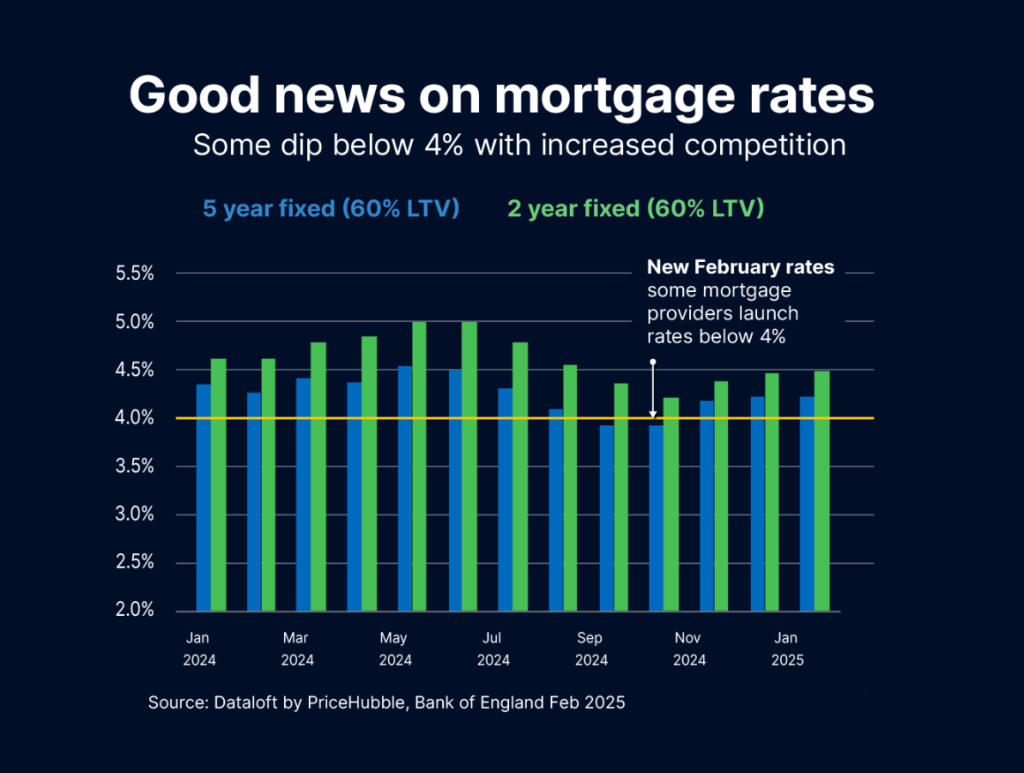

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…