- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Joint Life insurance covers two individuals simultaneously and offers a lump sum payout if either person passes away during the policy term.

By paying a single monthly premium, you receive one comprehensive contract that safeguards both named parties. With over 40% of policies being joint, this option is ideal for married couples, those in civil partnerships, cohabiting couples, long-term partners, and business partners.

On average, joint life insurance can lead to savings of around 25% compared to two individual policies, potentially up to 40% based on your specific circumstances.

At Mortgage Decisions, we offer detailed guidance to help you determine if a joint policy aligns best with your requirements.

To understand how a joint life insurance policy operates, both individuals must complete a single application form detailing their health, lifestyle, chosen policy, and coverage amount. Based on this information, insurers assess the collective risk to determine the monthly premium.

Once the policy is active, both partners are covered under a single policy for a unified monthly premium. In the case of ‘first death’ policies, if one partner passes away during the policy term, a payout is provided to the surviving individual.

You have the option to select from two types of coverage:

1. First death coverage

This prevalent joint policy type ensures the surviving party receives the payout upon the first death. After the payout, the coverage ceases.

2. Second death coverage, also called ‘joint survivorship life insurance’

Under this type, a payout is issued only when both parties pass away during the policy term. It’s important to note that joint life insurance provides a singular payout; thus, the policy concludes once a claim is filed.

Joint life insurance provides coverage for either you or your partner throughout the policy term in the unfortunate event of natural or accidental death.

In the event of a claim, the payout is directed to the surviving partner, offering financial support during a challenging period.

This payout can assist in meeting crucial expenses such as mortgage payments, rental costs, outstanding debts, household expenses, childcare or educational fees, and funeral arrangements.

Typically chosen by individuals with shared financial responsibilities, joint life insurance ensures these critical aspects are safeguarded in case of unforeseen circumstances.

In the case of second-death policies, the payout can help cover inheritance expenses for your children or fund the funeral arrangements for the second individual in the policy.

When considering the ideal Joint Life Insurance, it is important to choose a policy that provides a reliable financial cushion for one partner should the other pass away.

Your selection should align with your specific protection needs. Typically, Joint Term Life Insurance is a popular choice, offering options like level term and decreasing term coverage.

Additionally, you can explore alternatives such as joint Whole of Life Insurance or Family Income Benefit plans, which can be tailored to suit your requirements professionally.

A joint Whole of Life Insurance policy offers lifelong coverage and ensures a payout to the surviving partner upon the passing of either partner.

The received funds can be utilised to alleviate significant financial burdens such as outstanding mortgages, family maintenance costs, and funeral expenses.

When considering this policy, your overall health condition is factored in to determine the monthly premium costs. It’s crucial to note that if you have health concerns, paying higher premiums throughout your lifetime might result in you contributing more to the policy than what it will ultimately pay out.

Key Policy Features:

A joint family income benefit differs from a traditional life insurance policy by providing monthly payments (rather than a lump sum payout) if one partner passes away during the policy term.

It can help replace an income, allowing the surviving partner to continue their current lifestyle and cover essential family costs.

Receiving a regular payment can help them with long-term family budgeting instead of managing a large payout.

If a claim is made on the policy, the payments will commence from the date you or your partner passes away until the end of the policy term.

For example, if you have a 30-year policy term with a monthly payout of £2,000 and pass away 10 years into the policy, your surviving partner will receive £2,000 a month for the remaining 20 years of the policy.

As with joint term life insurance, joint family income benefit can be an affordable option for young couples or those on a budget.

Policy key features:

A Joint Life Insurance policy can be placed in trust, which can be especially advantageous when opting for a second death joint policy.

Placing your life insurance in trust transfers the policy rights to a trustee, akin to an executor in a Will. This action severs the policy proceeds from your estate, offering three key advantages:

1. Skips the probate process, resulting in a quicker pay-out.

2. Grants you the ability to specify how you want the proceeds divided.

When setting up Joint Life Insurance in trust, it is common for both individuals to designate each other as the primary beneficiaries. This arrangement enables both policyholders to jointly decide on the allocation of funds, such as clearing the remaining mortgage balance.

For insurance business we offer products from a choice of insurers.

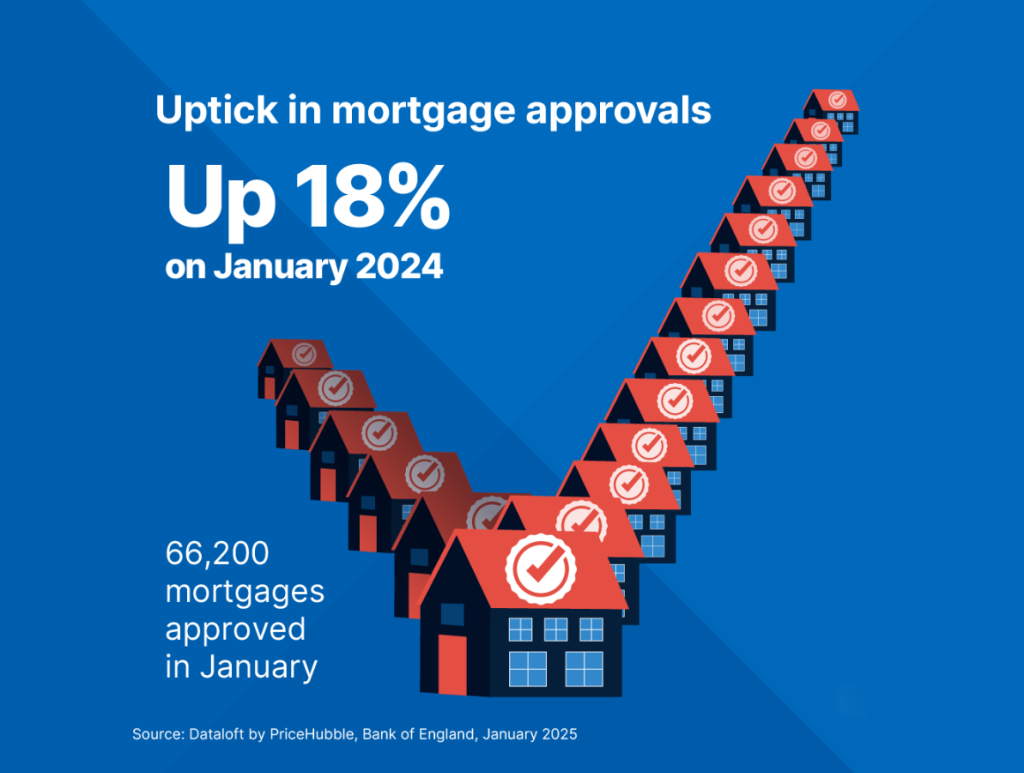

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

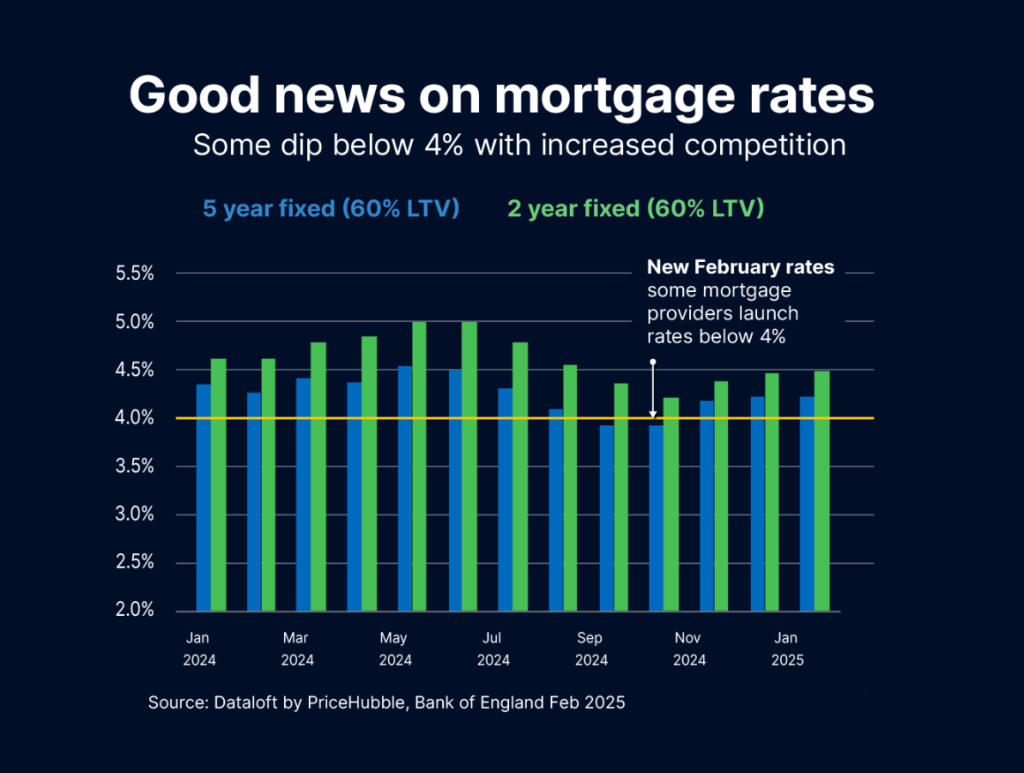

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…