- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Income protection insurance, also known as permanent health insurance, provides a regular income in the event that you are unable to work due to sickness or disability. This financial support continues until you return to work or retire.

The amount of income you can claim typically ranges from half to two-thirds of your pre-tax earnings from your usual job. This is due to deductions for any state benefits you may be eligible for, and the income from the policy is tax-free.

There is usually a waiting period of at least four weeks before you can start receiving income protection payments, although it may be as long as two years after you stop working. This waiting period allows for potential sick pay from your employer or statutory sick pay for up to 28 weeks.

It’s important to consider other types of illness insurance, such as critical illness insurance, before deciding on income protection insurance. Comparing different options will help you choose the most suitable coverage. For more information, refer to additional resources on illness insurance.

Always make an informed decision when selecting insurance coverage to safeguard your financial well-being in case of illness or disability.

Health insurance policies may not cover every type of illness, and you may not be covered for pre-existing medical conditions, which are illnesses that you or a family member had before. Insurers consider your family medical history, and while some policies cover existing medical conditions, others may not. Your insurer should clearly explain any conditions attached to the policy based on your medical history before you sign up.

It’s important to understand if you will still be covered if you can work in a different capacity than your current job. Some policies may not allow claims if you can work in another role. Review your insurance policy to clarify this aspect.

Regarding payout timing, most policies require a waiting period of at least four weeks after you stop working before payments begin. Some waiting periods can extend up to two years. Premiums may be lower if you can wait longer before making a claim.

Ensure you know the exact amount you’ll receive in a claim, as it may be influenced by other sources of income like state benefits or other insurance policies. Verify whether payments will increase annually to match the cost of living.

Insurers assess the risk level of your job when determining coverage and premiums. Job risk assessment can vary among insurers, so understanding how your job is categorised can help you find more affordable premiums.

Fully disclose your and your family’s medical history to the insurer. Omitting information may lead to a claim denial.

If you have a pre-existing medical condition, seek an insurer willing to cover it, even if it means higher premiums. Be transparent about engaging in risky hobbies or lifestyle choices like smoking, heavy drinking, or drug use to avoid potential claim issues.

You can send personal information directly to the insurer’s medical officer if you prefer not to discuss sensitive details with the policy seller.

Individuals in poor health or with high-risk jobs may face challenges in securing income protection insurance or may encounter higher premiums.

Income protection insurance costs are influenced by factors such as age, health status, occupation risk level, hobbies, lifestyle choices, waiting period, and willingness to work in alternative roles if unable to perform your current job.

Most policies allow a 30-day window to cancel and receive a full refund. After this period, refunded amounts may be less. Review your policy’s terms and conditions carefully, or seek assistance from our team of experts.

For insurance business we offer products from a choice of insurers.

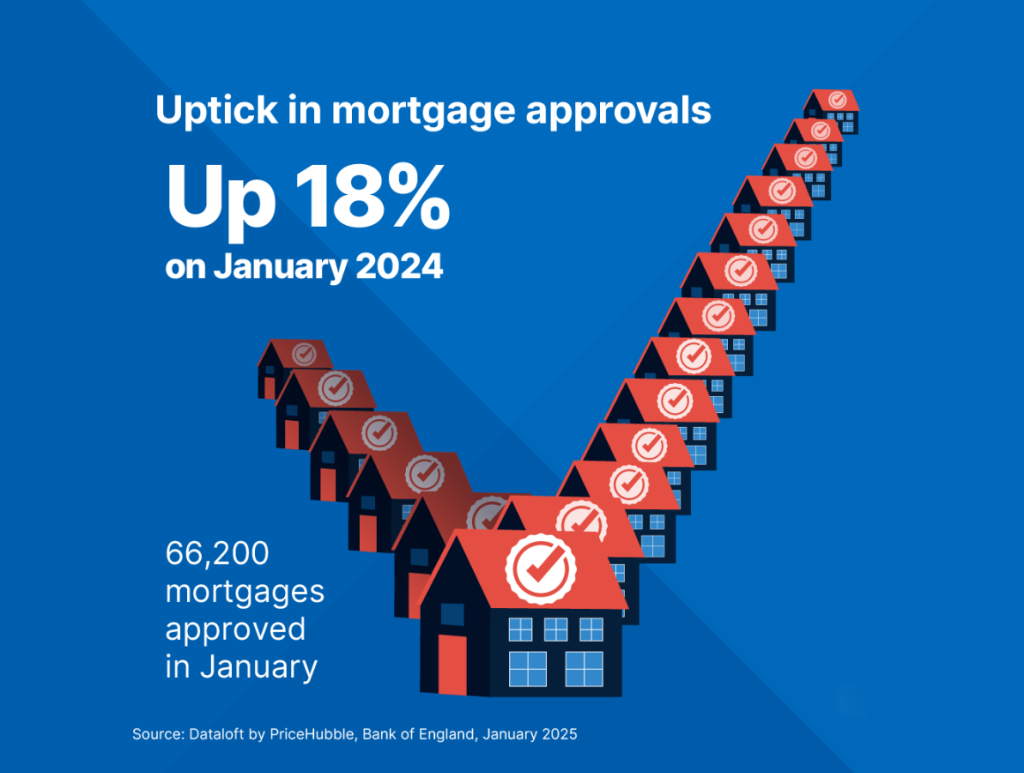

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

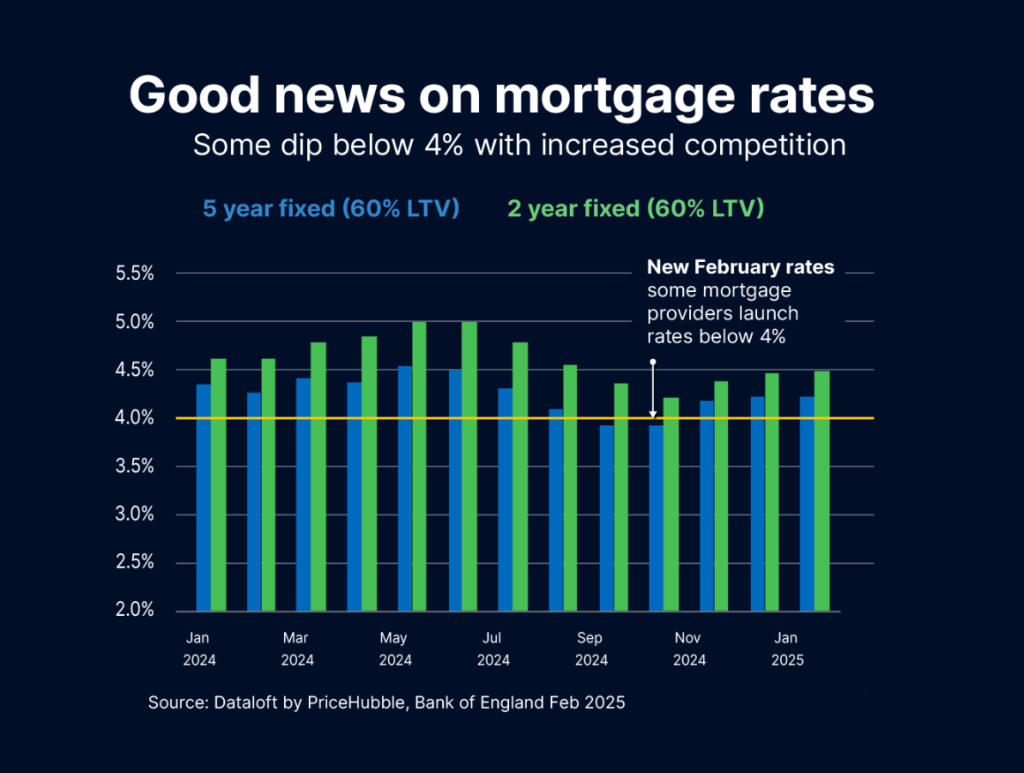

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…