- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

If you are self-employed or considering venturing into self-employment, it is crucial to assess your personal insurance needs. Unlike traditional employment, being self-employed means, you lack the safety net provided by an employer for sick leave and health insurance.

Without sick pay benefits, self-employed individuals may have to rely on state benefits in case of illness or injury. To safeguard against potential financial challenges due to sickness, injury, or critical illness, many self-employed individuals opt for income protection insurance and critical illness cover.

For those with dependents, such as partners or children, obtaining life insurance is often a prudent choice. Various personal insurance products are available for consideration by self-employed professionals.

Long-term income protection insurance ensures financial stability in the event of reduced earnings resulting from sickness or injury. Payouts under this policy typically continue until you can return to work or until the policy expires.

Short-term policies, such as accident, sickness, and unemployment products, provide coverage for a limited period, usually one to two years. These policies, including payment protection and mortgage payment protection insurance, aim to cover outstanding debts.

Critical illness cover offers long-term protection by paying out a tax-free lump sum upon diagnosis of a covered serious illness, such as certain cancers, heart attack, or stroke. This lump sum can be used to settle debts, mortgages, or home modifications to accommodate health needs.

While critical illness insurance does not provide benefits in the event of death, life insurance is essential for individuals with dependents who rely on them financially. Private medical insurance can complement NHS services and help mitigate income loss due to waiting for NHS treatments.

If you previously had employer-provided health insurance, transitioning to self-employment means losing this benefit. Considering private medical insurance allows you to tailor your coverage preferences and access care promptly.

Moreover, if you operate your business from home, it is vital to review your insurance coverage. Standard home or contents insurance policies may not fully protect business assets in a home-based business setup. Inform your insurer about your work-from-home status to ensure adequate coverage and prevent potential claim denials.

When establishing a home-based business, communicate your plans to your insurer to explore additional coverage options. Failure to disclose changes in your business activities may invalidate your insurance and lead to claim denials. Prioritise protecting your financial well-being by proactively addressing your insurance needs as a self-employed individual.

For insurance business we offer products from a choice of insurers.

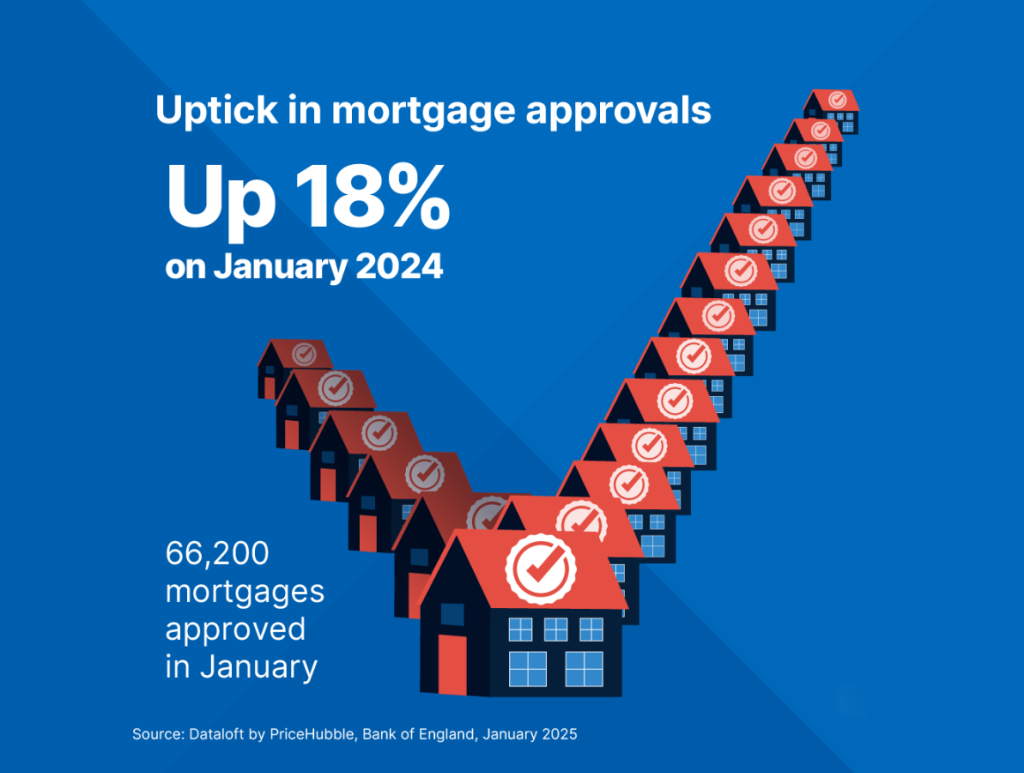

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

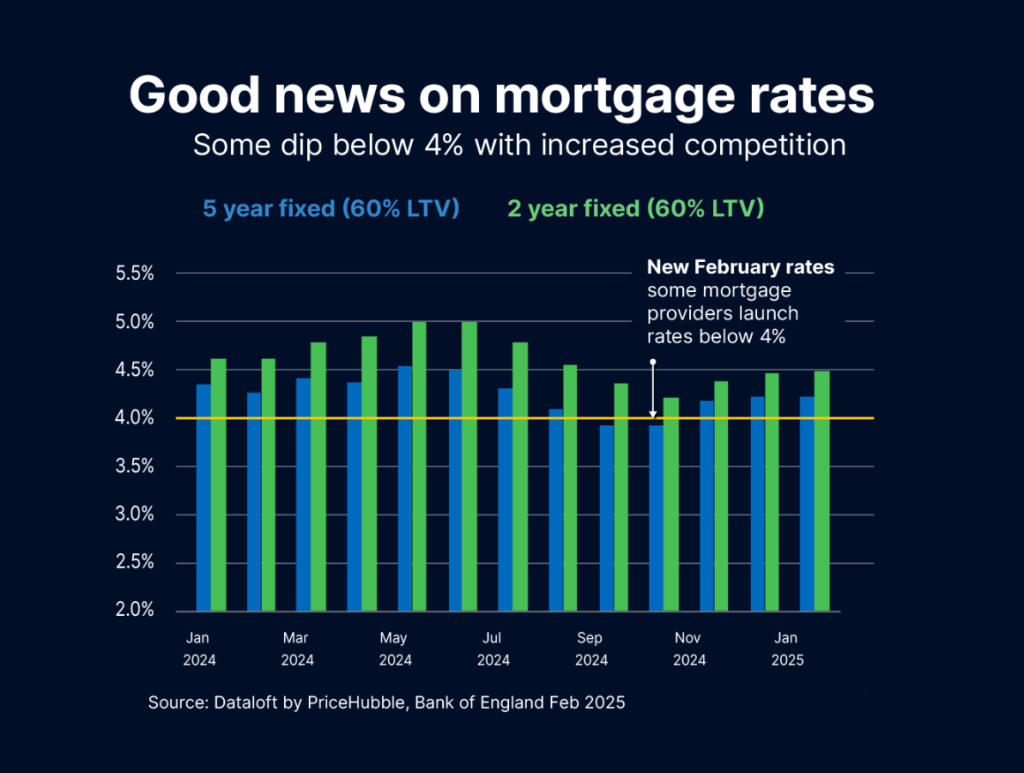

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…