- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

It facilitates long-term family budgeting with low-cost premiums starting from just 20p per day.

Depending on the provider, FIB could potentially payout up to £5,000 per month. Term lengths can extend up to 40 years, ensuring a professional and secure financial future for your loved ones.

Family Income Benefit (FIB), offers a distinct approach to life insurance. Instead of a lump sum payout, your beneficiaries receive regular monthly income payments upon your passing. These tax-free payments are designed to sustain their lifestyle seamlessly from the day of the claim acceptance till the policy’s end. Ideal for new parents or those with young families, FIB allows for affordable financial security, ensuring your loved ones can maintain their current standard of living in challenging times.

Family income benefit operates akin to conventional life insurance, allowing you to designate the desired amount for your beneficiaries and the coverage duration. In contrast to a lump-sum payout, your family receives monthly income instalments.

In the event of your passing, your loved ones can file a claim, initiating regular payments for the policy’s duration. This consistent financial support can assist your family in maintaining their lifestyle seamlessly after your passing, mitigating the need for significant lifestyle adjustments.

Speak to a member of the team to find out more.

Bear in mind, if you don’t pass away within your policy term, no pay out will be made and your policy will simply expire.

Determining the adequate family income benefit required is crucial and depends on your individual situation and the financial obligations you aim to safeguard for your family.

Family income benefit serves as a valuable resource for young families seeking to secure their ongoing living expenses and financial stability.

This coverage can effectively replace lost income post your death, facilitating your loved ones in upholding their present lifestyle.

Hence, when calculating your necessary coverage, it’s essential to evaluate:

Commonly, payments from family income benefit are used to help cover;

By compiling all your financial obligations, you can determine the total amount of funds necessary to assist your loved ones in meeting essential expenses.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

Family income benefit premiums are determined similar to other life insurance policies, relying on the probability of you filing a claim. As you apply, you will need to furnish essential details enabling insurers to evaluate your risk profile.

This information includes details about yourself as well as details about your policy, such as:

When opting for family income benefit, you face a choice between guaranteed premiums and reviewable premiums.

Guaranteed premiums offer consistency throughout the policy’s duration, ensuring that the price you pay remains constant.

On the other hand, reviewable premiums may present a more cost-effective option at the outset. However, it’s important to note that the insurer retains the authority to adjust these premiums over the policy term. This adjustment can stem from various factors like your age or changes in risk factors.

The cost of Family Income Benefit varies based on individual factors. Insurers consider your specific details to determine the premium.

Generally, premiums for this type of life insurance rise as you age. Securing coverage early can ensure a more favourable premium.

Determining whether family income benefit is suitable for you hinges on your individual circumstances. Given that each individual seeks life cover for diverse reasons, family income benefit might align well with your specific needs.

Below you’ll find the advantages and disadvantages of family income benefit:

If you need advice, or have a specific question about this, please contact one of our experienced team members. We can ensure you are given the right options to suit your personal situation.

For insurance business we offer products from a choice of insurers.

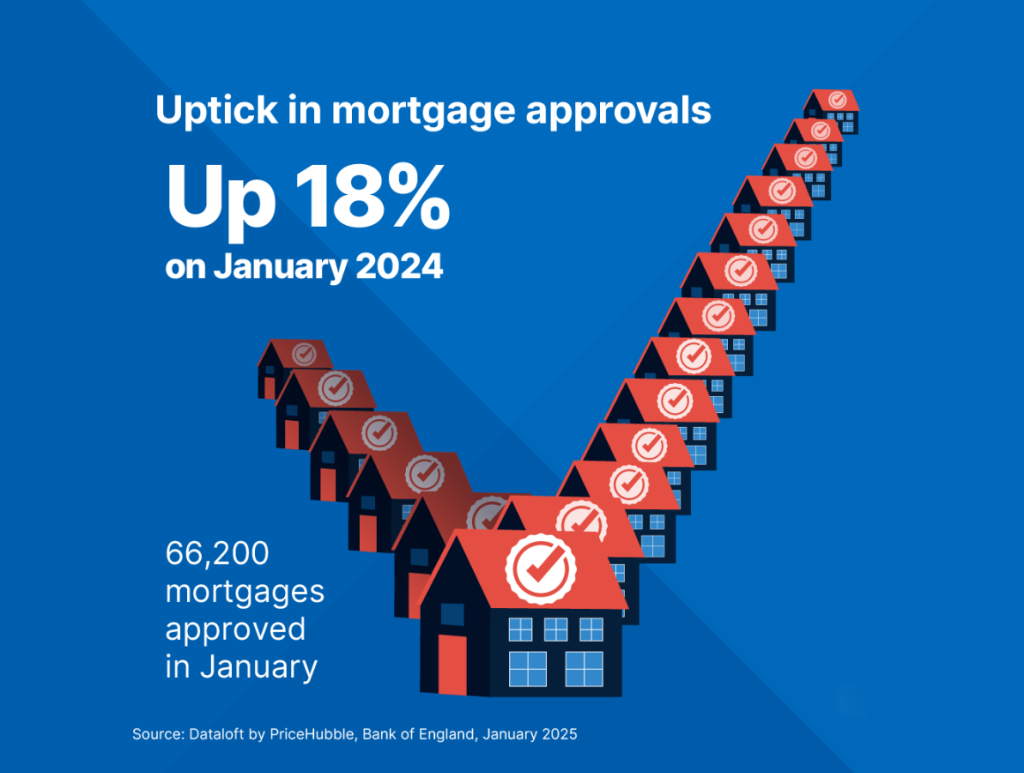

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

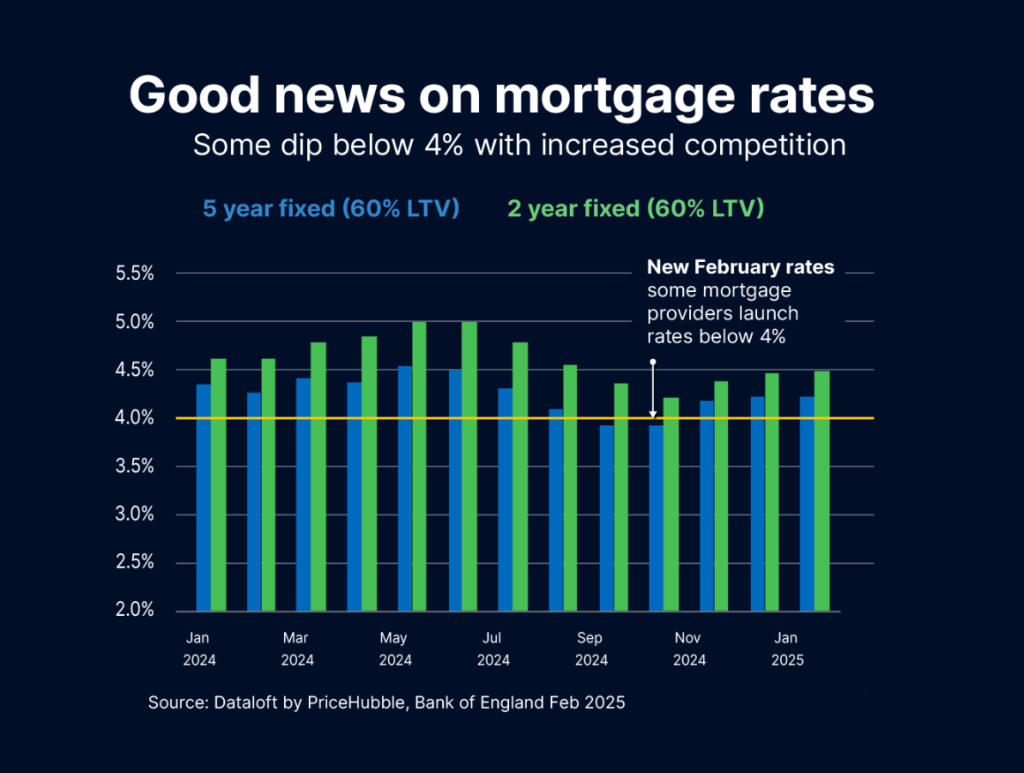

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…