- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

The predetermined sum assured and term length are established during the application process. Once the policy is active, monthly premiums are paid. Over the policy’s duration, the sum assured gradually decreases.

Consequently, as time progresses and a claim is made, the payout to your beneficiaries diminishes. This coverage is particularly beneficial for safeguarding a repayment mortgage since the sum assured aligns with the decreasing mortgage balance. The reduction in coverage amount is usually scheduled either monthly or annually, based on your specific policy and insurance provider. This policy comes with free terminal illness cover.

Securing sufficient life insurance can mitigate these concerns, safeguarding your family’s ability to maintain their residence.

Decreasing term life insurance typically stands out as the most cost-effective choice when considering life insurance options.

This form of coverage is usually more budget-friendly than both level term and whole life insurance policies, primarily because the insurer faces reduced risk of a substantial pay-out over time. As you progress through the policy term, the risk you present to the insurer diminishes, enabling them to offer you more affordable premiums.

Like all life insurance plans, the cost of your premiums hinges on several crucial factors, such as the extent of coverage needed, the duration of the policy, your age, smoking habits, current health status, and medical background. Individuals perceived by the insurer as higher risks for potential claims will likely face elevated premium rates.

The primary contrast lies in the sum assured.

While decreasing life insurance diminishes in value over the policy duration, level term insurance maintains a fixed sum throughout. This fixed sum ensures that your beneficiaries receive a consistent pay-out regardless of when you pass away.

Given the higher coverage level, level term insurance typically commands a higher premium compared to decreasing term insurance for the same sum assured.

Decreasing term insurance proves beneficial for covering a repayment mortgage as the pay-out aligns with the decreasing mortgage balance.

Conversely, level term insurance is more suitable for addressing expenses that do not decrease over time, such as an interest-only mortgage, inheritance, or funeral costs.

A decreasing term policy provides a life insurance payout to your loved ones if you pass away during the set term.

As a result of being term-based, it is possible to outlive your policy, and your beneficiaries do not benefit from your investment. The value of the pay-out will obviously be influenced by how far into the policy you pass away.

After you are gone, your beneficiaries simply need to claim on your policy to receive the proceeds.

Whilst decreasing term life insurance is designed to cover a repayment mortgage, it is not guaranteed to cover the full balance.

To help ensure this, it is crucial that your mortgage interest rate does not exceed that of your decreasing term policy.

If the interest rates do not correlate, the sum assured from your life insurance could decrease faster than your mortgage balance, meaning a pay-out may not be sufficient to cover what is owed.

Insurers offer different interest rates, therefore, when arranging your policy, it is essential to compare quotes to ensure you get the right cover.

Changing your mortgage can increase the amount you owe your lender and change the interest rate.

Both of these could affect the suitability of your decreasing term life insurance policy.

Remortgaging your property is a common occurrence for a number of reasons:

Borrowing more money from a lender could mean that the sum assured you originally arranged is no longer sufficient to cover what is owed on your property.

However, some providers allow you to evoke a special events option in this circumstance. This allows you to increase your level of cover without the need for any additional underwriting. You should check whether this option is included in your policy.

A change of interest rate could mean that your sum assured now declines at a faster pace than the remaining balance of your mortgage.

As a result, a payout may not provide the necessary funds to cover the remaining mortgage, if the worst were to happen to you.

Regardless of your reason for remortgaging, it is always best to get in touch with your insurer to ensure your policy still meets your needs.

The biggest criticism of a joint life insurance policy is that it only pays out once (usually on the first death). This then leaves the surviving partner uninsured.

Equally, if both partners were to die simultaneously, one pay-out may not be sufficient to cover to the loss of two people, (especially if you have children).

However, if the sole purpose of the cover is to help pay off the mortgage, this is likely to be sufficient to meet the needs of loved ones.

If you have additional costs to cover level term life insurance may be more suitable.

When considering decreasing term life insurance, it is typically structured to safeguard your mortgage. Statistically, the likelihood of experiencing a critical illness is higher than that of passing away.

For a supplementary fee, integrating critical illness coverage into your life insurance policy becomes feasible. This feature ensures a pay-out upon diagnosis of a severe but non-terminal illness.

It proves invaluable in aiding with mortgage payments during an extended period of incapacity to work.

When setting up your mortgage, numerous lenders may offer you the chance to buy decreasing term life insurance. While life insurance might be mandatory for your mortgage approval, there’s no obligation to buy coverage directly from your lender.

Interestingly, many lenders earn commissions from these sales, potentially leading to inflated costs for you. By comparing various decreasing term insurance quotes, you can pinpoint the policy that aligns best with your requirements. Engaging a reputable broker to conduct this analysis can assist you in uncovering the most cost-effective quote from our network of insurers.

For insurance business we offer products from a choice of insurers.

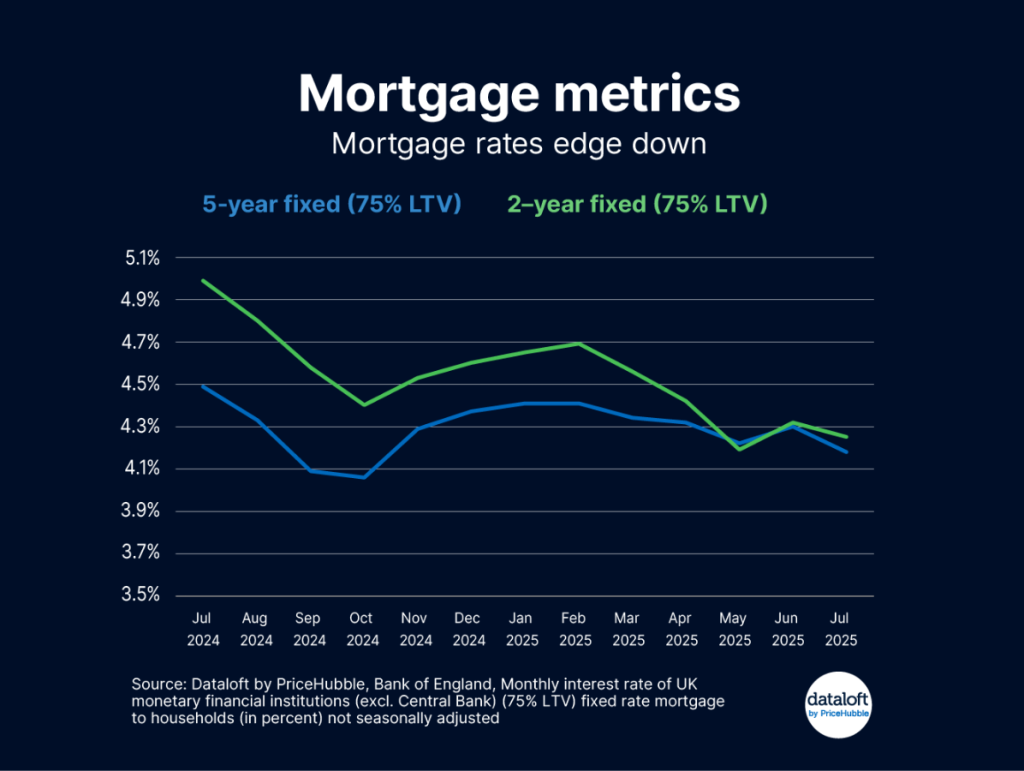

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…