- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

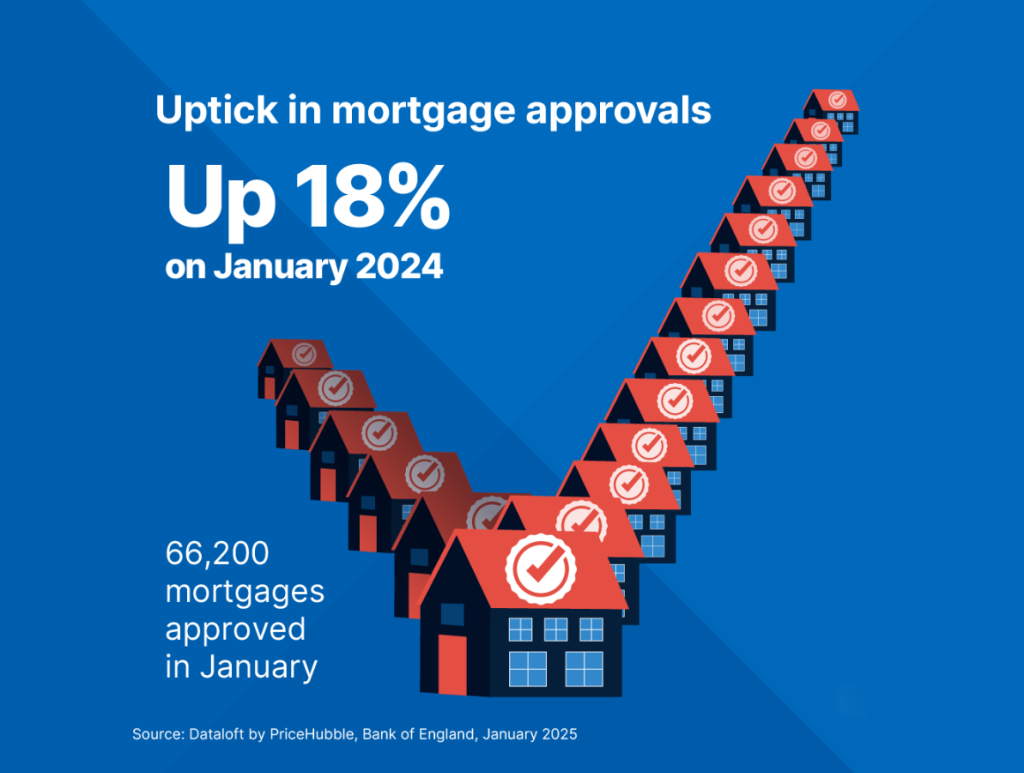

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000...

The Bank of England cut the Bank Rate on 1 August from 5.25% to 5%, indicating confidence that inflation, which remained at the 2.0% target in June (ONS), is slowly...

After two years of nearly continuous interest rate increases by the Bank of England, followed by an additional year of persistently high rates that have placed considerable strain on many...

Date: July 2024 With a new Labour government and greater political clarity, coupled with the real prospect of Bank of England rate cuts on the horizon, confidence is returning to...

Inflation fell to just 2.3% in the 12 months to April 2024, close to its 2% target (ONS). As the economic outlook improves, consumer confidence in May reached its highest...

The Bank of England has held the current interest rate at 5.25% for the sixth time in a row. However, the Bank of England Governor Andrew Bailey said he was...

We are thrilled to announce our sponsorship of the Southern Affordable Homes Show, the largest event of its kind in the south. With access to thousands of new homes spanning...

The Bank of England maintained its Bank Rate at 5.25% in March, aligning with widespread expectations. This marks the fifth consecutive freeze since the rate reached its current level in...

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.