- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

Life insurance becomes a crucial consideration as individuals age, providing financial security for loved ones and covering funeral expenses. Despite reaching the age of 60, obtaining a suitable policy is not as daunting as it may seem. There is a diverse range of products tailored for individuals over 60, ensuring that you can find a plan that suits your needs.

Over 60s life insurance encompasses various options, including term life, whole life, and guaranteed over 50s plans. Upon approval, you will pay a monthly premium, and in the event of your passing, a lump sum will be provided to your chosen beneficiary. For those over 60, a guaranteed over 50s plan offers acceptance without the need for medical history consideration, ensuring coverage for UK residents aged 50 to 85.

Different policies have unique features, such as whole life cover that continues until death, guaranteeing a payout as long as premiums are maintained. Fixed term cover requires medical information and does not guarantee acceptance. Increasing term policies adjust premiums and payouts over time to combat inflation, whereas decreasing term policies keep premiums constant as payouts decrease. Level policies maintain fixed premiums and pay-outs throughout the term.

Although not strictly life insurance, funeral plans serve a similar purpose by locking in current funeral costs and releasing funds upon death. Premium payments typically span one to ten years, making funeral plans more costly in the short term than traditional life insurance.

The cost of a life insurance policy varies based on individual circumstances, with insurers assessing risk factors to determine premiums. While age plays a role in pricing, factors such as health conditions and coverage amount also influence costs. Opting for an over 50s policy with guaranteed acceptance can simplify the process and eliminate the need for medical underwriting.

Selecting the right policy involves considering your specific needs and preferences, ensuring that you choose a plan that aligns with your financial goals.

For insurance business we offer products from a choice of insurers.

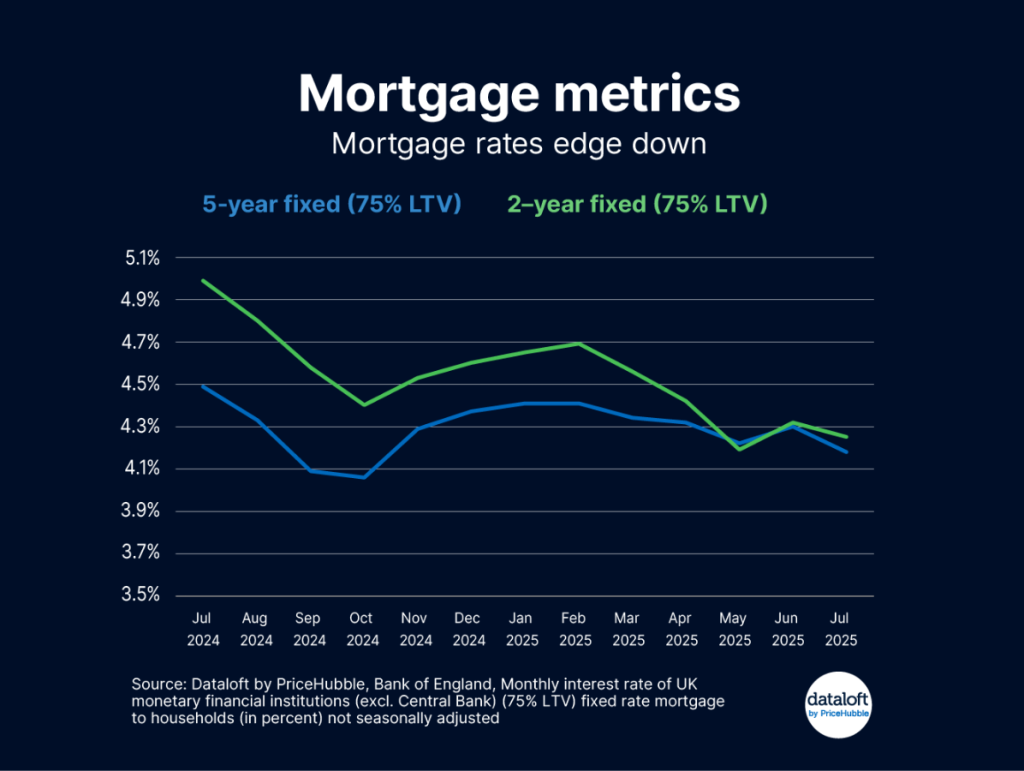

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…